Ethereum continues to demonstrate resilience, outperforming broader market trends as its price climbs amid sustained bullish sentiment. Over the last 24 hours, the second-largest crypto recorded a 2.72% rise. More notably, its weekly surge of 11.51% has drawn attention, highlighting strong buying activity. At present, Ethereum trades at $4,619.94, holding steady within a defined range.

Despite a 22.37% drop in 24-hour trading volume to $46.06 billion, its market capitalization remains strong at $557.66 billion. The reduction in daily activity suggests some cooling off after the recent rally, yet the price trajectory shows continued optimism. Analysts stress that Ethereum’s ability to hold above $4,300 has been a decisive factor in maintaining the bullish outlook.

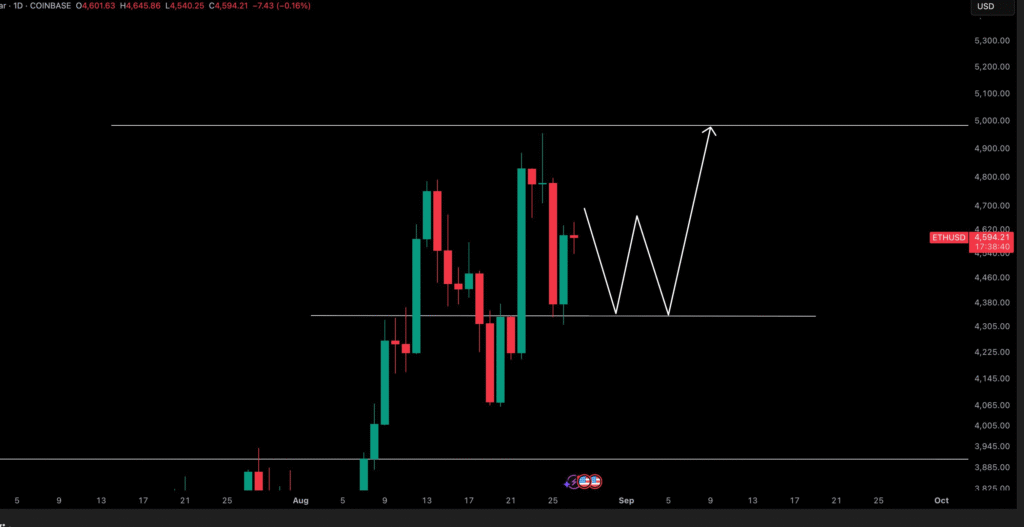

Ethereum technical chart patterns signal key levels

The ETH/USD daily chart reveals price consolidation between support at $4,300 and resistance at $5,000. With Ethereum trading at $4,620, the mid-range position reflects market indecision. Candlestick patterns show a balance between buyers and sellers, often a precursor to a significant breakout or breakdown.

Forming of “W” on the chart indicates a likely double bottom formation. That formation, if it comes into existence, will back bullish perspectives. Ethereum will possibly test $4,300 again before making a recovery, preparing the ground for an eventual breakout above $5,000. That will possibly lay the ground for further higher target ranges of $5,300–$5,500.

For this scenario to come into play, Ethereum has to keep the $4,300 support line intact. Bullish signs, i.e., strong volumes near support levels or bullish engulfing bars, will emphasize this prediction. A clear break below $4,300 will invalidate the bullish structure and drop the price down to $3,900 and lower.

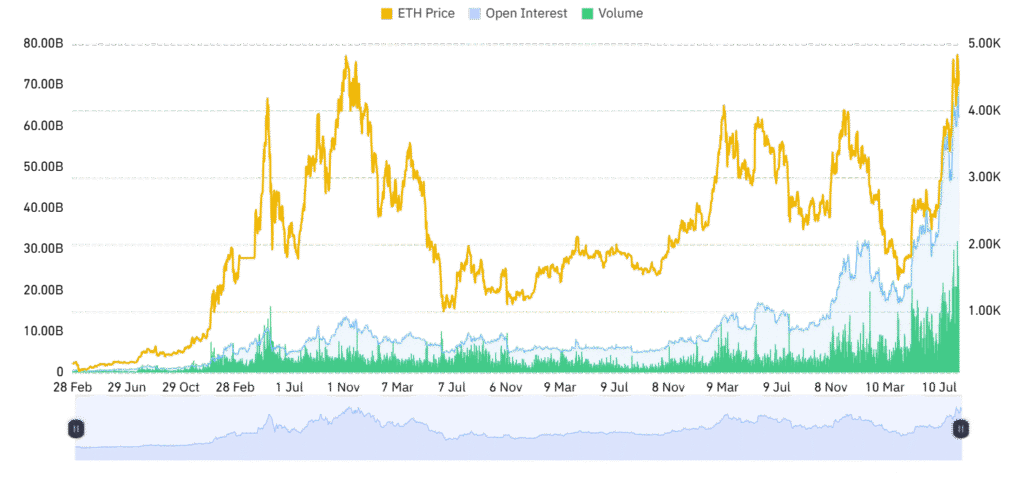

Open interest climbs to record highs

Open interest of Ethereum has gone up by 0.45% and is now $63.97 billion for the first time in history. This development has signaled Ethereum derivatives participation influx with market participants adding leveraged positions. Previously, such developments have often accompanied key breakouts of prices, which suggests bullishness on Ethereum’s near-term outlook.

Stepped-up open interest can also heighten the risk of volatility. Over-leveraged markets are also susceptible to rapid corrections since immediate liquidation has the potential of widening swings of prices. Analysts recommend keeping sharp eyes on trends of volume and open interest developments. Price movement and participation trend divergence can show an overheated marketplace or forthcoming reversal.

In the short term, Ethereum’s bullish trajectory remains intact. Strong support levels, rising open interest, and rising investor interest continue to keep alive the hopes of a breakout for $5,000.