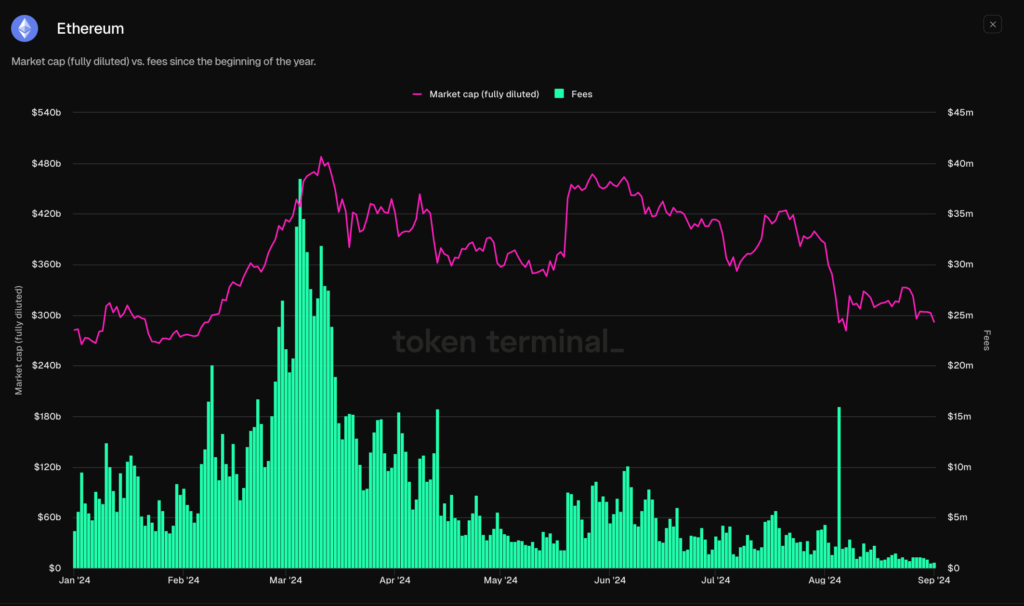

Since Mar. 2024, Ethereum layer-1 network revenue has dropped by a staggering 99%, even though the number of monthly users and daily transaction costs on layer-2 solutions have surged. Token Terminal reported that network fees peaked at $35.5 million on Mar. 5, 2024.

However, just a week later, on Mar. 13, 2024, the Dencun upgrade went live, significantly lowering transaction fees for Ethereum’s layer-2 solutions. After the upgrade, network fees were consistently reduced, reaching a low of $566,000 on Aug. 31. They saw a slight rise to $578,000 by Sept. 2, 2024.

Ethereum L2 fee drop sparks scaling race

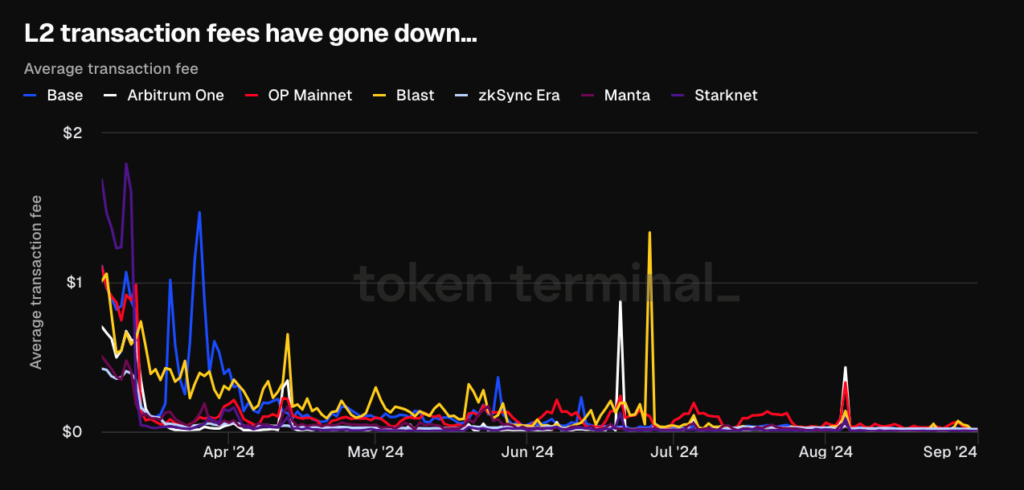

The Dencun upgrade caused Ethereum Layer 2 fees to drop significantly, leading to a surge of new Layer 2 scaling solutions. According to L2Beat, 74 Ethereum Layer 2 projects and 21 Layer 3 projects are listed. Anoma CEO Adrian Brink believes there are far more Layer 2 solutions than the market needs.

He estimates that the number of Layer 2 solutions available is about ten times greater than the industry requires. Companies are racing to offer the lowest transaction fees to attract customers in this intense situation. As they compete, more users are shifting away from using Ethereum directly, creating a cycle where the drive for lower fees pushes costs down even further.

Low fees drive inflationary supply demand

The recent Dencun upgrade has made transactions much cheaper, which has countered the effects of EIP-1559. EIP-1559 introduced a system that burns a portion of transaction fees to reduce the supply of Ether (ETH).

However, with the lower fees from Dencun, there’s now less demand for ETH, the currency used for these payments. As a result, the amount of ETH in circulation has gradually increased since Dencun was introduced.

Related | Japan proposes tax reform for crypto gains in 2025