An Ethereum-based decentralized borrowing protocol, Liquity, saw massive outflows in just 24 hours. Over $17 million left its v2 Stability Pools. This came after Liquity warned users to exit positions from the newly launched Liquity v2 Stability Pools.

On Feb. 12, Liquity said it was investigating a potential issue in its v2 earn pools. The team did not share many details. Liquity v2 launched on Jan. 23, offering user-set borrowing rates.

The Liquity team confirmed they were looking into a possible problem with v2 Stability Pools. They assured that core functions remained unaffected. Borrowers could still withdraw collateral. Staked LQTY positions were safe. BOLD remained fully backed and redeemable.

Out of caution, Liquity urged users to close their Stability Pool positions. They also warned about scams. Users were told to interact only with trusted frontends. No team members would send direct messages. There was no private support desk. Scammers might try to exploit the situation.

Impact of Liquity v2 outflows on token pools

The warning triggered a sharp drop in Liquity v2. Data from DefiLlama showed over $17 million in outflows. The total value locked (TVL) on it fell by 18%. It dropped from its peak of $84.9 million on Feb. 11 to $69.6 million.

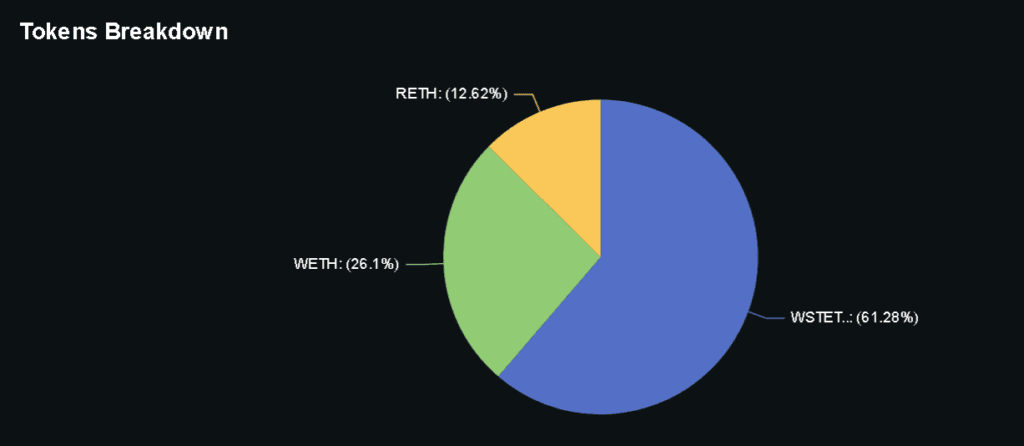

Liquity v1 remained unaffected. Investors kept their funds there. The exodus mainly impacted the v2 pool, which holds three tokens: Rocket Pool ETH (RETH), Wrapped Ether (WETH), and Wrapped Lido Staked Ether (WSTETH).

WSTETH saw the largest outflow, losing around $11.3 million. There was a loss of $1.2 million in RETH, and there was a loss of $4.5 million in WETH. Ethereum staking platform Lido also informed holders of WSTETH. The Liquity team continues investigating the issue. They will updates only through official channels. Users must stay cautious and rely on trusted sources for information.