The U.S. Securities and Exchange Commission (SEC) revoked the Crypto accounting rule that made U.S. financial firms wary of offering services in the crypto space. Known as Staff Accounting Bulletin (SAB) 121, it required firms holding crypto assets to delineate them as liabilities on the balance sheets.

The SEC introduced the rule in March 2022, sparking criticism from the crypto industry, which has been lobbying to repeal it since hearing about it. On Jan 23, the SEC ended SAB 121.

Ethereum’s role in DeFi and potential price breakout

Markus Thielen, head of research at 10x Research, called the SEC’s decision a pivotal moment for Ethereum. According to Thielen, this change could catalyze the expansion of DeFi services, positioning Ethereum as the backbone of the DeFi ecosystem.

In a Jan 23 market report, Thielen highlighted Ethereum’s current price formation, describing it as a “low-risk, high-reward opportunity.” Though not a consistent Ether supporter, he highlighted its potential for a breakout beyond the recent triangle pattern.

Influential factors driving Ethereum future

Ethereum co-founder Joseph Lubin highlighted two key factors influencing Ethereum’s future price trajectory. Optimism is growing that Ethereum staking ETF issuers are nearing regulatory approval. This approval would increase institutional adoption and strengthen Ethereum’s position in the market.

Second, Lubin suggested there could be a business move on the part of the Trump administration in the crypto space. It might launch a huge Ethereum-based business, and the interest in the blockchain was swept away. Details remain speculative, but such further demand for Ethereum’s native token, ETH.

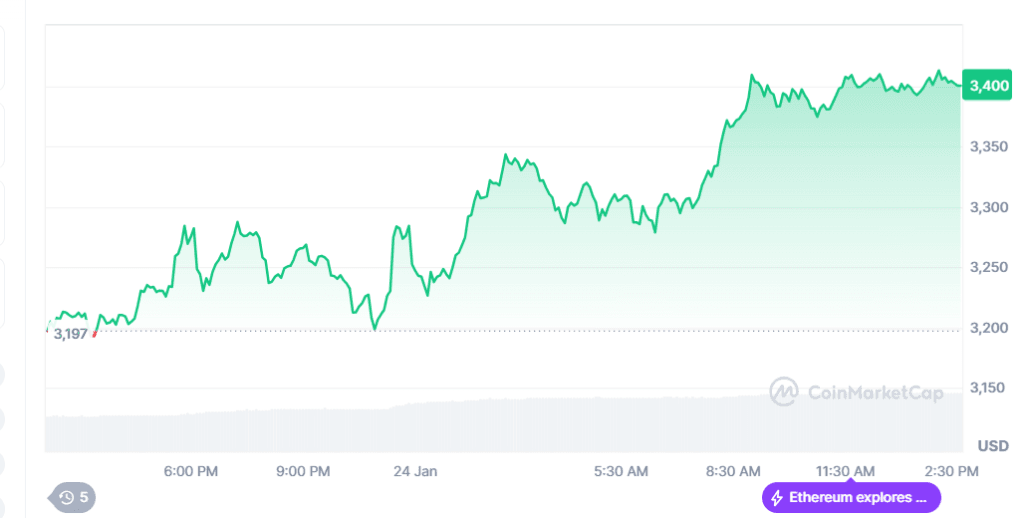

Ethereum struggled to maintain bullish momentum, with a 6.49% increase from $3,197 to $3,406 over 24 hours at the time of the report. The trading volume has also increased by 64% to $35.57 billion, and the market capitalization rose 6.50% to $410.42 billion. The aggregate cryptocurrency market appears to be enjoying heightened confidence and activity here.