Stablecoin issuer Tether announced a major cross-chain swap on November 6, transferring over $2 billion worth of USDt to the Ethereum network from various other blockchains. In this transfer, Tether is moving 1 billion USDt from the Tron network, 600 million USDt from Avalanche’s C-Chain, 300 million USDt from the Near Protocol, and 60 million USDt from the EOS network, all to Ethereum.

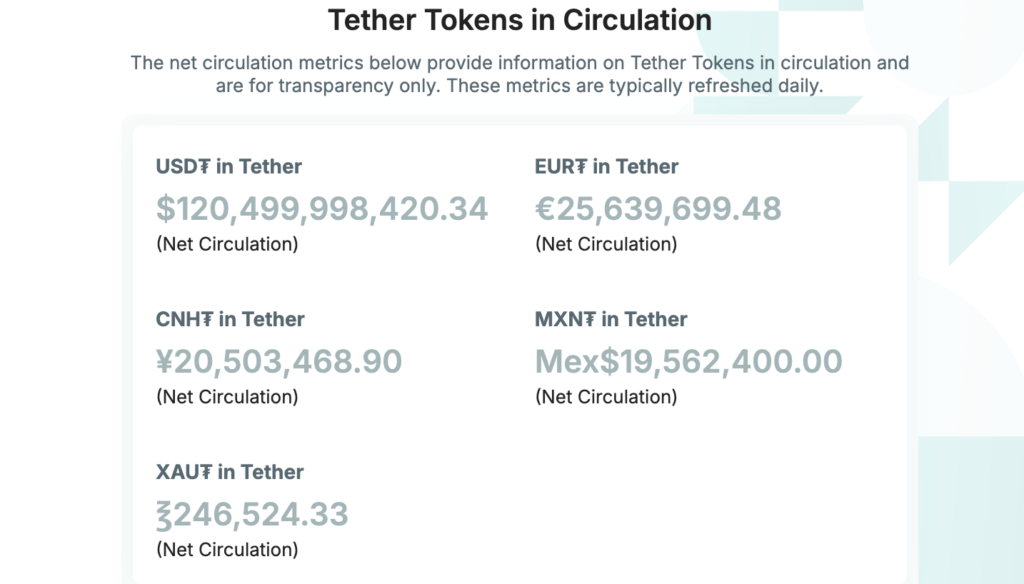

Specifically, this move is part of Tether’s efforts to optimize its token distribution across different blockchain ecosystems. Tether clarified that they carried out a cross-chain swap to help a major, unnamed exchange move their USDt holdings from several cold wallets over to the Ethereum blockchain. Moreover, Tether reassured investors that this large transfer wouldn’t impact the overall supply of USDt in circulation.

A recent major transfer of USDt across blockchains followed a report by The Wall Street Journal claiming the U.S. government is investigating the stablecoin company for possible money laundering and sanctions violations.

Tether reserves and market reactions

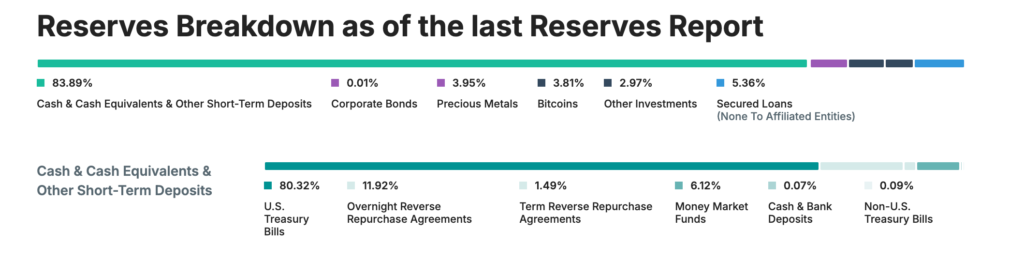

Following the news, crypto markets took a quick dip as fear, uncertainty, and doubt unsettled investors. Additionally, concerns about the biggest fiat off-ramp in the digital asset market led Tether’s CEO, Paolo Ardoino, to break down the company’s reserve assets backing its dollar-pegged stablecoin at the PlanB event in Lugano, Switzerland.

The reserve assets comprise around $100 billion in U.S. Treasury bills, 82,000 Bitcoin valued at about $6.2 billion based on current market rates, and 48 tons of gold, reaching a record high of $2,790 per ounce in U.S. dollars. In Oct. 2024, USDt reached a market cap of $120 billion, a milestone many traders view as a signal of active trading in digital assets, often hinting at a positive outlook for prices.

However, Chainalysis data shows a shift in how stablecoins are used: instead of fueling market speculation, they’re becoming a safe haven in countries facing steep currency devaluation.

Related | Investors turn to Bitcoin despite crypto headwinds