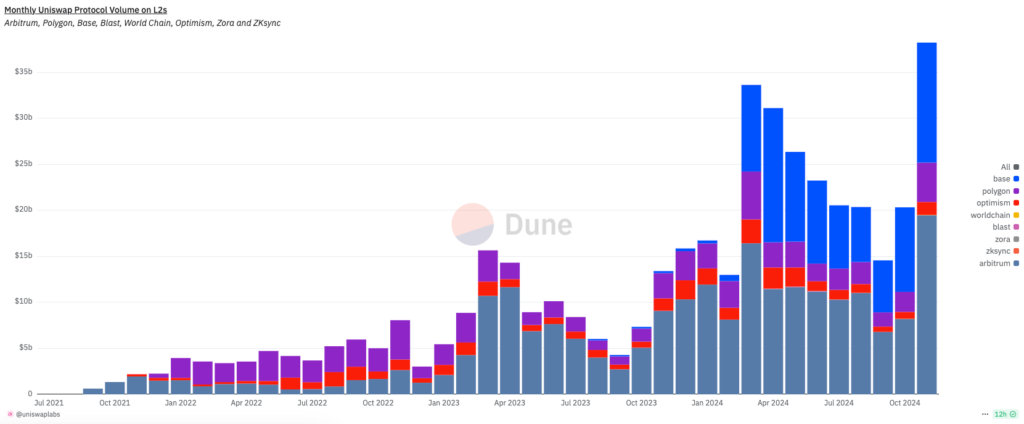

Uniswap recently set a new record for monthly volume across Ethereum layer-2 networks as decentralized finance (DeFi) enthusiasts returned to the ecosystem. Data from Dune Analytics shows that Uniswap reached an impressive $38 billion in volume across major Ethereum layer-2 platforms like Base, Arbitrum, Polygon, and Optimism, among others.

The November record beat the previous highest month, set in March, by $4 billion. Apollo’s chief investment officer, Crypto Henrik Andersson, explained that the surge in Uniswap volumes on Ethereum layer 2s can be credited to a growing demand for assets and stablecoins within the broader DeFi ecosystem. He said:

[This is] in line with the DeFi renaissance and the recent increase in ETH/BTC. Onchain yields are also rising.

UNI surges 42% as Uniswap hits $38B volume

Andersson mentioned that this recent surge might start a long-awaited period of strong performance for Ethereum. He pointed out that whenever Bitcoin nears the $100k mark, they’ve seen Ethereum and DeFi coins start to get momentum. Uniswap saw its highest monthly volume on Arbitrum, reaching $19.5 billion, while Coinbase’s incubated network, Base, came in a close second with $13 billion.

Uniswap is the sixth-largest protocol in terms of fees, earning more than $90 million in the past month. This impressive figure puts it ahead of other platforms, including the Solana memecoin launchpad Pump.fun and major networks like Tron and Maker. Uniswap’s native token, UNI, has seen a significant rise, reflecting the increased activity on the protocol. Furthermore, its price has surged by over 42% in just the past week.

Currently, UNI is trading at $12.58, showing a 10% jump in the last 24 hours. Overall, UNI has outperformed other decentralized exchange tokens, showing stronger growth than Raydium, which dropped 2.2% this past week, and Jupiter.

Related | VanEck reaffirms $180K Bitcoin target amid bullish sentiment