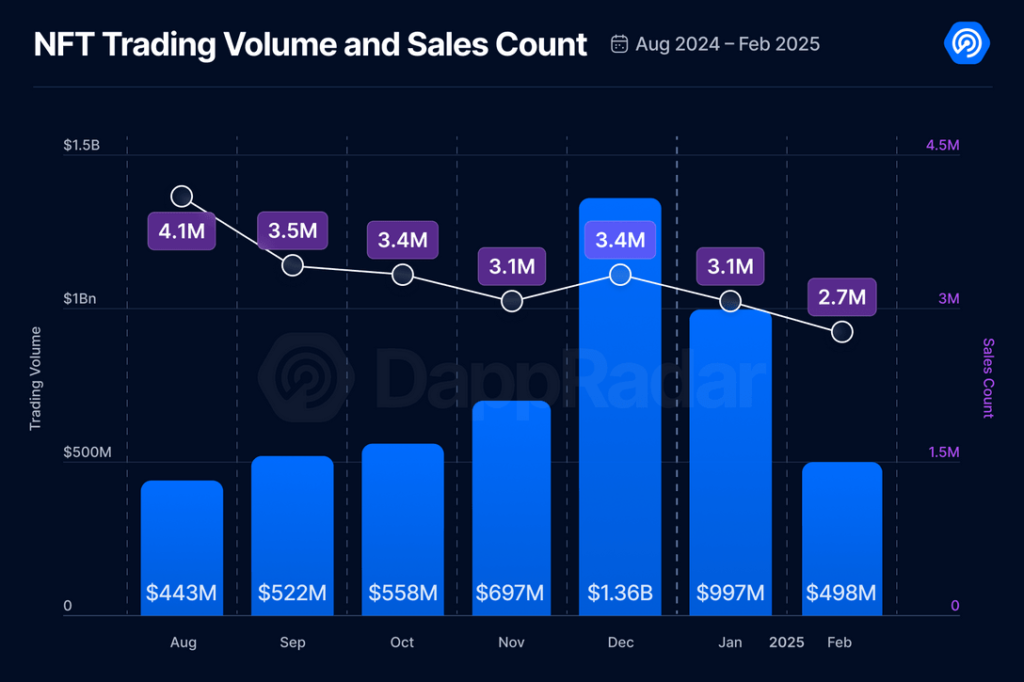

Since growing as a digital sector, the NFT market has shrunk significantly. Trading activity fell by 63% between Dec. 2024 and Feb. 2025. The market traded $1.36 billion worth of assets, which decreased to $498 million. Investors and industry participants show rising concern regarding the NFT market’s direction because of its declining trends.

During Dec. 2024, the NFT market achieved its highest trading volume of $1.36 billion. Its market value dropped from $1.36 billion in Dec. 2024 to $498 million two months later in Feb. 2025, resulting in a 63% decline. The sudden drop follows a general market contraction that shows cryptocurrency and NFTs share a systematic relationship.

Factors contributing to the market downturn

Various elements have created problems for the current market situation. The extensive growth of NFT projects throughout the market has created challenges for all individual tokens because the space looks excessively crowded. The present economic risks and worldwide monetary problems have led investors to practice restraint when purchasing digital collectibles. New regulations across its market have caused investment doubts because regulatory agencies monitor this landscape more closely.

The market experiences a general decline, but certain areas show strong resistance. AI-powered NFT collections represent the speediest growing segment in the Web3 technology space. Significant interest has been directed at these collections because they introduce unique distinguishing features apart from standard NFTs.

Future outlook: Potential for recovery

The NFT market holds an uncertain future before it. Although the current market slump is notable the supporting technologies along with NFT applications maintain their active growth. The market predictions reveal that it will enact tender phases prior to becoming more exclusive about quality instead of massive volume expansion. The market needs investment into NFTs that deliver practical benefits to achieve its recovery.

The NFT market shows substantial price swings as part of its position in emerging digital assets markets. Trading volumes have decreased by 63% since Dec. 2024, yet this situation creates space for market rebalancing that focuses on building lasting business growth. Stakeholders must actively protect their interests while following changing market requirements. This is in order to find stable sectors, including AI-enhanced NFTs, as they handle current market complexities.