Pump.fun has registered over 1.3 million active addresses within the month of August. Despite high volume of trading, the aggregate loss of the users was $66 million. Currently, the price of the token is at $0.003417 with a 24-hour volume of $431.57 million, a market cap of $1.21 billion and a dominance of 0.03%.

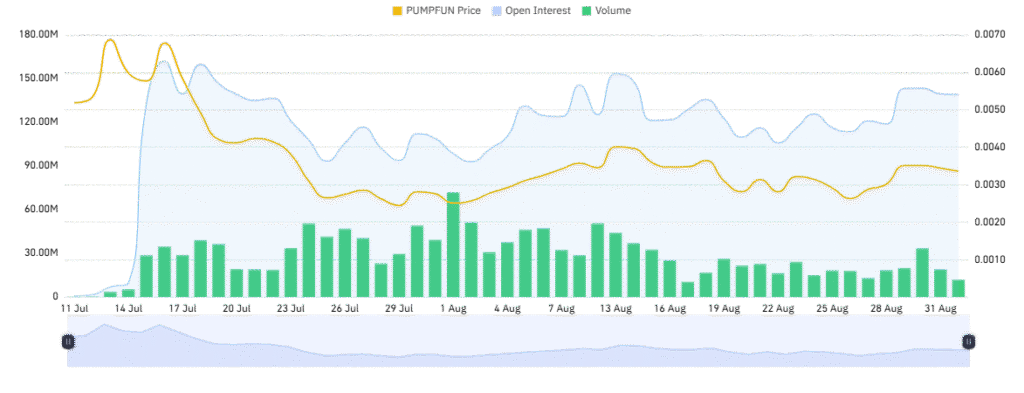

Pump.fun reached its historical peak of $0.00744 on July 14, 2025, and fell to its cycle low of $0.002285 on July 29, 2025. Current 24-hour volume milestones show a satisfactory 3.03% increase, marking short-term optimism amidst the current challenges of traders.

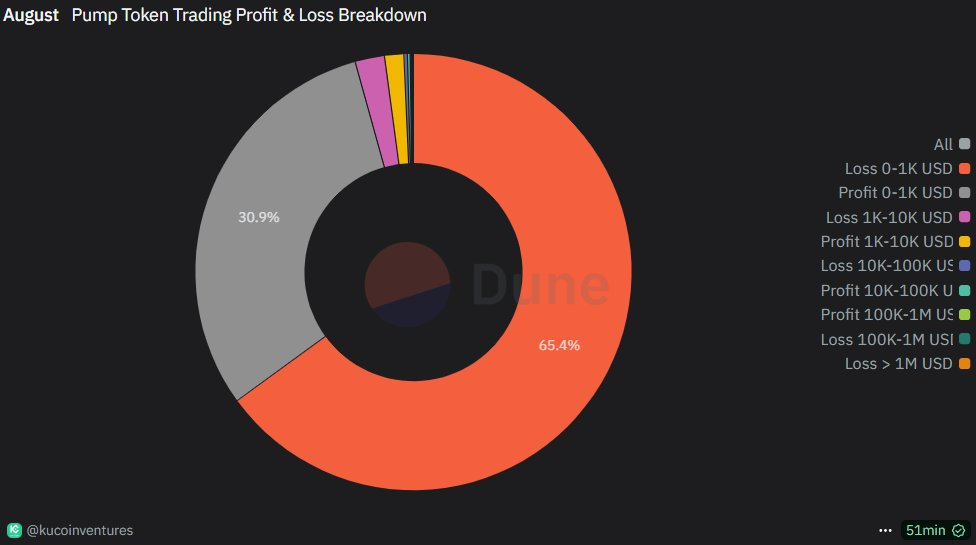

In August, Pump.fun generated 595,000 new tokens, reclaiming its top position among Solana launchpads, according to crypto researcher Defioasis. Close to 1.35 million addresses actively traded these tokens, yet profitability was low. Over 60% of traders ended the month red and none of them earned over one million dollars.

Approximately 882,000 wallets or 65.4% of addresses lost between $0 and $1,000. Average loss was $73.41 per wallet. Even though individually minimal, this category represented more than $64 million lost overall and shows the risks and volatility of Pump.fun token trading at this period.

Roughly 416,000 addresses came up with moderate payments of up to $1,000 or roughly $100 less. An additional 18,000 wallets earned between $1,000 and $10,000. Only 1,665 addresses made payouts of more than $10,000. Overall, the platform ended the month of August with net losses of $66 million, dwarfing individual payouts.

Pump.fun buybacks and derivatives activity

Pump.fun purchased $58.7 million of the PUMP tokens from the open market to stabilize. Total buybacks now exceed $66.6 million and have cleaned up over 17.5 billion tokens at $0.003765 on average. This was aimed at reducing selling pressure and making sure token prices were sustained regardless of high volatility.

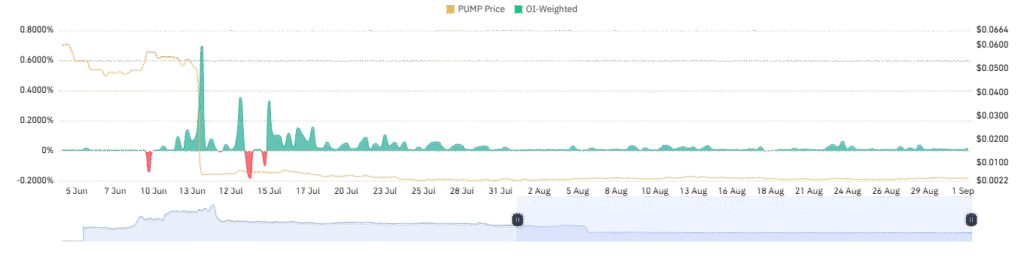

The PUMP derivatives market was highly active. Open interest gained 1.58% up to $455.03 million and the turnover surged 31.76% up to $572.16 million. It is a sign of fresh money entry into the market, higher participation, and higher intraday optimism of traders despite spot market loss on the day.

OI-weighted data is at 0.0197% and shows low leverage levels. Traders are entering with low extreme risk-taking and are holding the market steady. Price movement is still present yet the conservative level of OI-weighted suggests that PUMP is not too extended and can gain if volume momentum is maintained.