The U.S. Securities and Exchange Commission has once again delayed decisions on two altcoin ETFs. According to official filings, the regulator extended deadlines for Canary’s HBAR ETF and Grayscale’s Polkadot ETF. This marks another cautious step, fueling speculation across the broader cryptocurrency community.

Canary HBAR ETF faces third delay

The Nasdaq first applied for the Canary spot HBAR ETF on Feb 21 and later made changes on March 4. The SEC approved the application on March 13, and it went into its review period. The regulator has already delayed decisions twice, namely in April and June.

The SEC has now extended the timeline again, setting November 8 as the final deadline. This represents the third postponement since March. The commission continues to seek additional public commentary, most prominently on listing under Nasdaq’s commodity-based trust shares rule, which governs commodity-focused exchange-traded products.

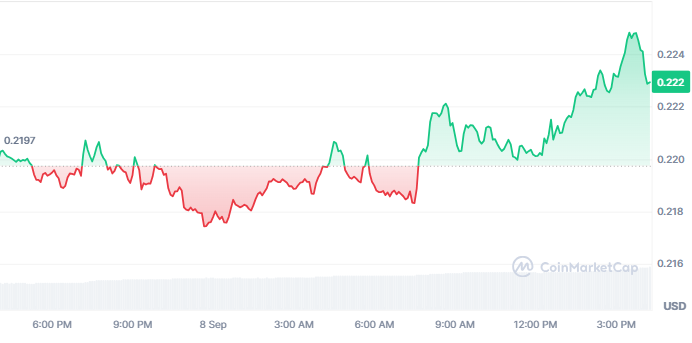

The Hedera (HBAR) coin reacted modestly to the news. The price gained 1% in the last 24 hours, reaching $0.2226. The day’s low and high stand at $0.2174 and $0.2222, respectively, a sign of tentative optimism despite the lengthy review period by the SEC.

SEC Grayscale Polkadot ETF ruling

The Grayscale Polkadot ETF follows a nearly identical timeline to Canary’s HBAR application. Nasdaq filed earlier this year, with the SEC repeatedly extending reviews. The regulator issued the filing extension again to November 8, in line with the move it carried out on the Canary spot HBAR ETF filing.

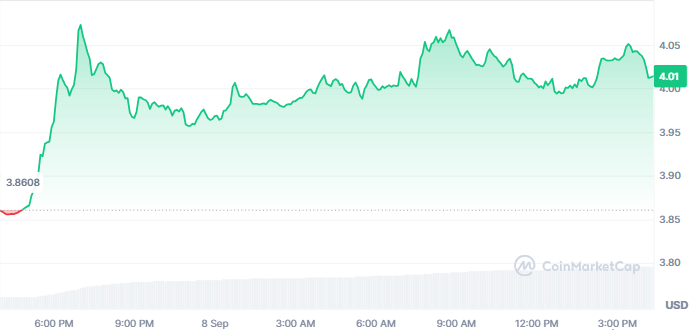

Polkadot’s response was stronger. DOT surged nearly 4% to $4.01, reaching intraday lows and highs at $3.85 and $4.08, respectively. Even the trading volume rose by 225% in 24 hours, showing strong interest among investors despite continuous hold-ups by the regulatory agency.

The SEC verified that it needs more time to determine if altcoin-tracking ETFs can be added as part of the proposed changes in rules by Nasdaq. The agency made it specific that it wants consistency in standards before approving products, aside from Bitcoin and Ethereum, the sole approved spot ETFs so far.

The major exchanges, including Nasdaq, NYSE, and CBOE BZX, have already updated their applications. These updates alter the definition of “commodity” by excluding “excluded commodities,” which are designed to achieve a more defined crypto ETF template. The SEC appears set on settling on these standards first.

While November 8 is still the most likely deadline, the crypto market is looking ahead. If approval comes to pass, the go-ahead signal could extend well beyond HBAR and Polkadot, and potentially signal a greater altcoin ETF approvals wave, giving investors greater access to the markets in digital assets.