Solana price has remained solid above $200, and the momentum continues to intensify on both technical charts as well as on-chain data. Traders eye the resistance zone of $210 to $220, a zone that has consistently halted surges since the month of March. A move past this level may trigger wider targets.

Active trading drove the Solana ascent, whose 24-hour volume was observed by analyst MartyParty at $33.3 billion to position it second after Bitcoin and Ethereum. Funding rates remain steady to reflect leverage contained, although open interest keeps increasing on large exchanges.

Crypto analyst Ted suggested that the retrieval of $220 would be a springboard towards $250 and even $270. Technical analysis depicts an ascending triangle formation, which tends to favor breaks when it comes on the back of surging volume. The current formation depicts the way the momentum is building towards this decisive phase of prices.

Resistance retest signals growing pressure

On the daily chart, Solana is pressing against a resistance line that has stopped several rallies since spring. Analyst CRG commented that the asset is “extremely close to breaking out,” as price trades within the $211 to $215 range. A daily close above $220 would confirm a breakout.

When volume keeps growing and resistance finally breaks, the chance of follow-through gets stronger. A technical setup backed by higher volume often attracts solid buying. With repeated attempts at the same level, traders believe the chances of success improve, especially when the broader market also shows strong participation.

For many market watchers, the battle at $210 to $220 represents a decisive point. Success above this threshold would not only invalidate months of stalled rallies but also open the way toward a higher band around $240 to $250, placing $270 firmly within reach afterward.

On-Chain data and retail interest

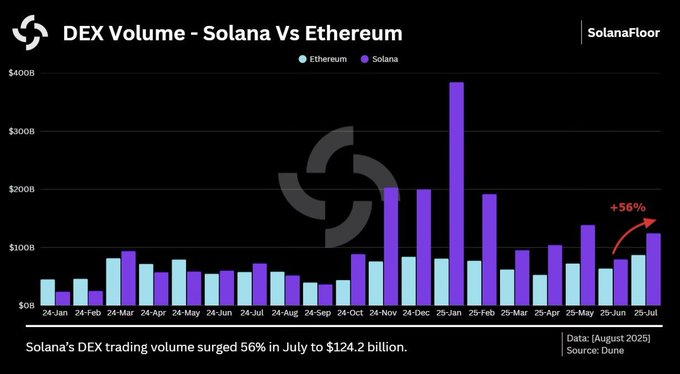

Fresh on-chain data adds extra support. For ten straight months, Solana has recorded higher decentralized exchange trading activity than Ethereum. According to SolanaFloor, the network cleared $124 billion in DEX volume during July, a 56 percent monthly increase that shows strong momentum behind the current bullish trend.

Retail sentiment also plays a role. Analyst Zach noted that while searches for Bitcoin and Ethereum remain far from previous peaks, Solana has reached record highs in Google Trends interest. This shift signals growing attention that often correlates with rising liquidity inflows and stronger breakout conditions.

Momentum around Solana is forming at the right level and time. Price strength, trading volume, on-chain growth, and retail attention are aligning as the token faces its most important test in months. A confirmed breakout above $220 could propel price action toward $250 and $270 targets.