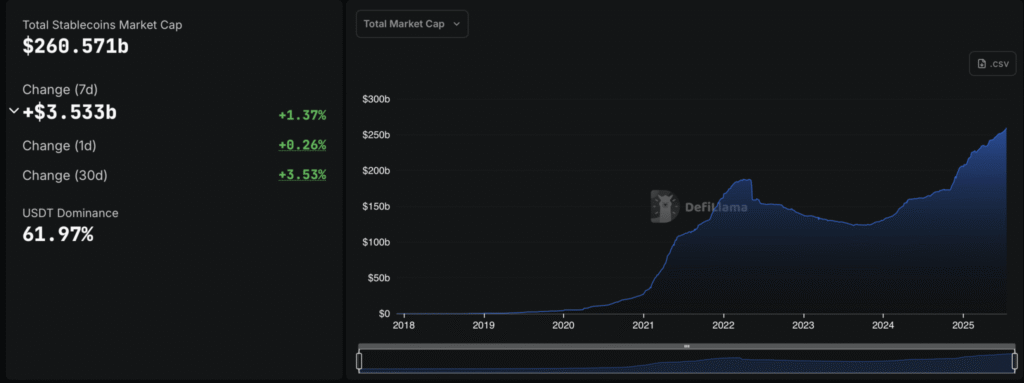

The stablecoin market just crossed a major milestone. Its total value rose to $260.571 billion on July 19, 2025. In the last seven days alone, the sector added $3.533 billion. That marks a 1.37% weekly growth. Over the past month, the increase hit $8.87 billion, or 3.53%, since June 19.

This growth didn’t happen suddenly. Stablecoins have slowly grown into a major part of global finance. Back in January 2020, the total stablecoin market cap stood at only $5.26 billion. In five and a half years, that figure jumped by over 4800%.

Stablecoins found new uses in crypto apps

The DeFi boom in 2020 sparked the rise. Investors began to use stablecoins in lending, trading, and payments. As blockchain apps matured, these digital dollars found broader use. People used them for fast transfers, yield farming, and cross-border payments.

Centralized platforms also joined the wave, offering stablecoin services to retail and institutional users. The market hit a rough patch in 2022. Terra’s UST collapsed in May, and the FTX crash followed in November. Trust in crypto took a hit. The stablecoin market dropped from nearly $200 billion to much lower levels.

But the fall didn’t last forever. By mid-2023, recovery signs appeared. In the time since, stablecoins added $137 billion in value. That marks a 110.97% rebound from the post-crash low. This comeback shows clear signs of strength.

Traders and developers depend on Stablecoins

Stablecoins keep proving their worth in real use cases. Developers rely on them in DeFi apps. Traders use them to park funds. People around the world send them across borders to avoid high fees. More businesses now accept them for payments.

The market didn’t grow from hype. The increase reflects solid demand. Strong regulation also helped. With the GENIUS Act now law in the U.S., the rules offer clarity for issuers and users. That boost in trust plays a role in the sector’s recovery and expansion.

Stablecoins are no longer just tools for traders. They are becoming part of daily digital life. As their market cap passes $260 billion, they stand firm as a key layer of modern finance. Whether through decentralized apps or centralized platforms, stablecoins now serve real needs and keep growing.