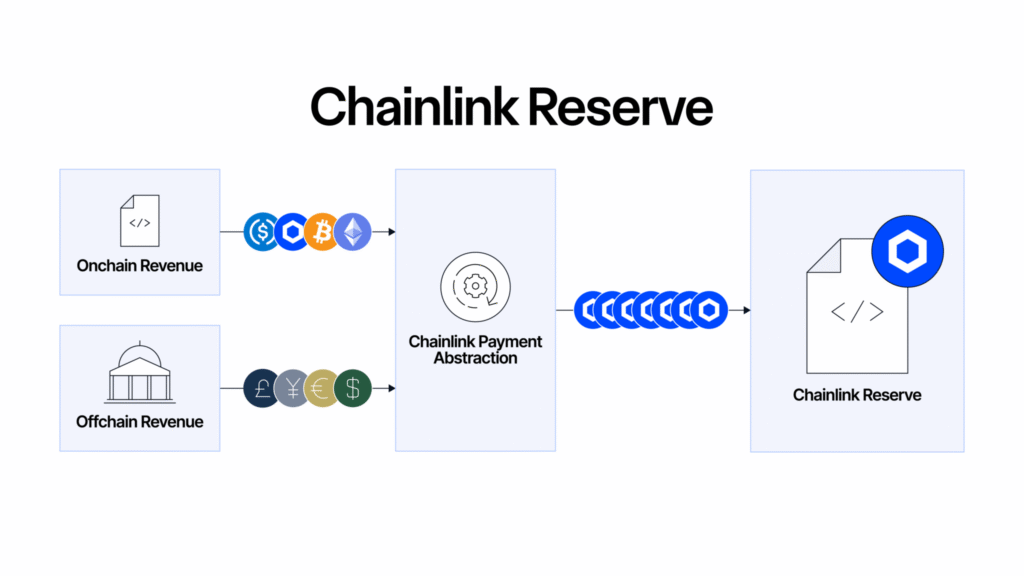

Chainlink has introduced a new initiative called the Chainlink Reserve. This on-chain pool collects LINK tokens from enterprise payments and service usage. The reserve already holds around 65,500 LINK, worth roughly $1.16 million. This step aims to support the long-term sustainability of this Chain network.

It constructed this reserve with an abstraction called Payment Abstraction. It allows users to pay with their desired token, such as ETH or stablecoins, and it converts their payments into LINK automatically. All this happens through smart contracts as well as decentralized exchanges.

Chainlink reserve grows with institutional payments

This Chain mainly uses Uniswap V3 to handle these conversions for now. Large firms often pay off-chain to access Chainlink’s infrastructure. Now, those payments can also feed into the reserve. This Chain has expanded Payment Abstraction to support this model, covering both off-chain and on-chain revenue sources.

As more institutions integrate Chainlink services, the reserve is expected to grow. Chainlink has stated it will not touch the reserve funds for several years. The pool acts as a strategic buffer. It also signals confidence in the network’s long-term role in blockchain infrastructure. The reserve builds on Chainlink’s broader goals of economic stability and adoption.

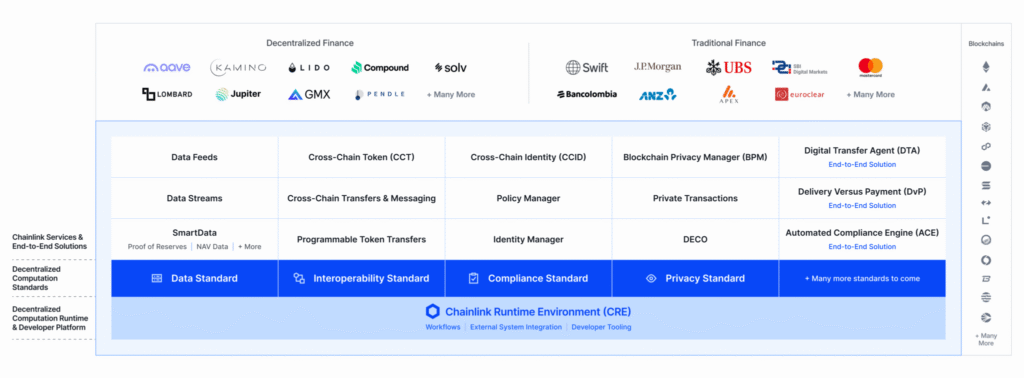

The network has brought in hundreds of millions in revenue already. It supports more than 2,000 data feeds on over 60 blockchains. Key DeFi players, as well as mainstream finance, rely upon its services to get price information as well as cross-chain messaging.

Chainlink builds a bridge between TradFi and Blockchain

Chainlink considers itself the bridge between old-school systems and new-age blockchains. The platform’s modular framework means that developers are free to mix and match tools when building sophisticated applications. Chainlink has offerings like data feeds, automation, and cross-chain messaging, among others.

It believes this adaptability places it in a favorable standing in the tokenization movement growing in global finance. The Reserve is just one part of an overall economic policy. This Chain also has staking, subscription plans, and revenue-sharing programs. Upgrades to its new system look to reduce operational costs while making the network operate efficiently.

By accumulating LINK gathered in service fees, Chainlink guarantees that network revenue keeps pace with its expansion. The Reserve illustrates how Chainlink is gearing up for a future where financial systems intertwine with blockchain. As it gains wider use, the LINK reserve will likely grow with it.