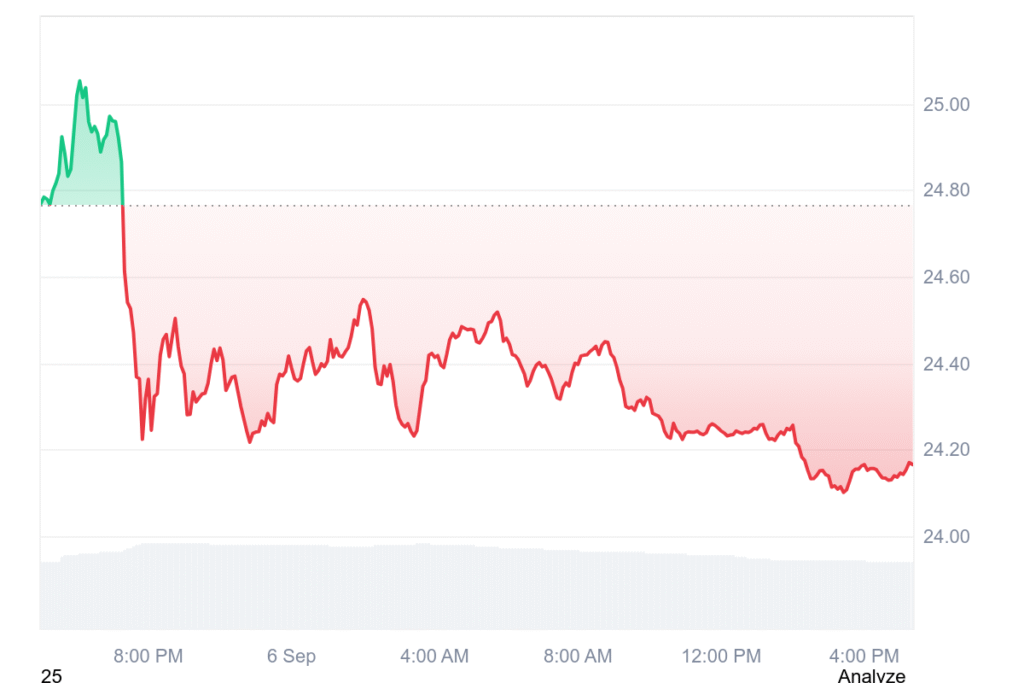

AVAX is trading under bearish pressure and experiencing a decline in its price, in line with the crypto market. As Bitcoin has started its downward momentum, it has impacted the overall market, including altcoins like AVAX. But the coin is trading inside an ascending triangle pattern, which often leads to a bullish reversal, and experts are also predicting a bullish reversal, which may lead to a maximum profit zone around 28.

At the time of writing, AVAX is trading at $24.15 with a 24-hour trading volume of $519.54 million and a market cap of $10.2B. The INJ price over the 24 hours is up by 2.53%, and over the last week is up by 1.83%, showing high potential for the next major rally.

Source: CoinMarketCap

Avalanche shows potential with 28 in sight

According to the crypto analyst, Avalanche (AVAX) is trading near $24.30 and remaining stable on its rising trendline from early September. The support line has acted as a significant bottom for bulls, and the overall upward setup for the token has remained resilient against current price action. This strength sets AVAX up to potentially test higher resistance levels if momentum persists.

Source: X

Traders think that as long as the AVAX does not violate this trendline, the possibilities remain open for a potential charge toward the $26–$28 area, which contains expected levels of resistance. Additional strength of purchases at or near current levels has the potential of generating the momentum required to test such lofty destinations in the near term. If the buying pressure continues to increase, AVAX might confirm a bullish breakout and extend its rising rally.

Caution still dominates, however. A decisive fall down from the trendline would provide a bearish indication of deteriorating bullish momentum, and focus would again remain on the $22–$23 support region. The current price level is, therefore, a make-or-break point for Avalanche, and market participants eagerly watch if bulls maintain the form or bears regain supremacy. A breakdown could also create more selling momentum and increase short-term volatility.