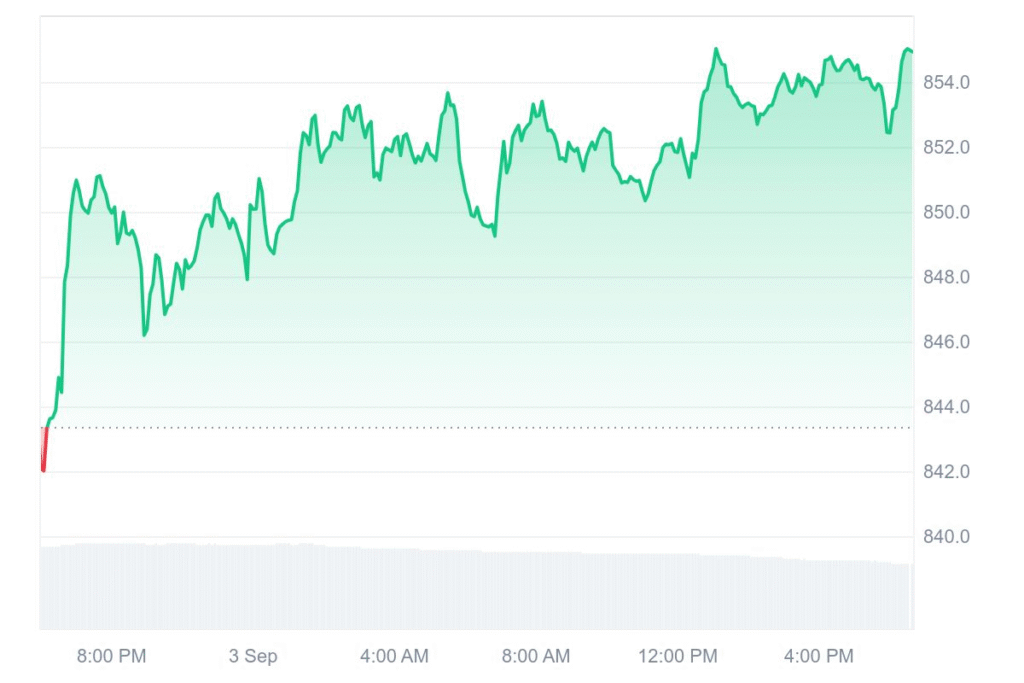

BNB is trading at $854.93, recording a slight 0.97% increase. Market players noted keenly as 24-hr volume dropped sharply by 21.04%, to $1.97 billion. Despite that volume decrease, BNB’s price remained relatively stable over the previous week. Market sentiment looks stable, even though broader crypto indices fluctuate.

The analysts assume that stability can be a sign of consolidation. In the short term, BNB action appears to be compressed, predicting a potential breakout. Traders are keenly monitoring the $806 support level. If such floor gives away, BNB can dip to around $770. A clean breakout on the other hand can trigger a fresh surge in long positions.

Volatility remains in the background

Crypto analyhst Lennaert Snyder notes that BNB is “casually chilling at its all-time high.” He pays particular attention to the $806 liquidity zone, calling it a major retest area. Snyder warns that breaking below it can usher in the next support around $770. To its opposite, breaking above resistance can unleash major buying activity.

Analysts also say that BNB’s price action reflects broader market caution. Consolidation of the coin can hold out best-case scenarios for short-term trend-followers. Volatility hovers in the background, and market participants remain vigilant. Retail and institutional trader plans down the road may be dictated by BNB’s future moves.

BNB future price predictions

DigitalCoinPrice foresees that the value of BNB is going to rise in 2025. It thinks that it is capable of going further than $1,872.74 in that year. It can first exceed its all-time high of $899.70 before that. If it maintains that rising trend, then it can stay between $1,773.14 and $1,872.74.

Changelly is less outspoken with their prediction. They foresee that BNB can hit $574.03 or reach $625.17 in 2025. The average price can be $676.31, meaning that it can lose its value of close to 26.4%. For September 2025, it can trade between $610.33 and $676.31, with an average of close to $643.32.