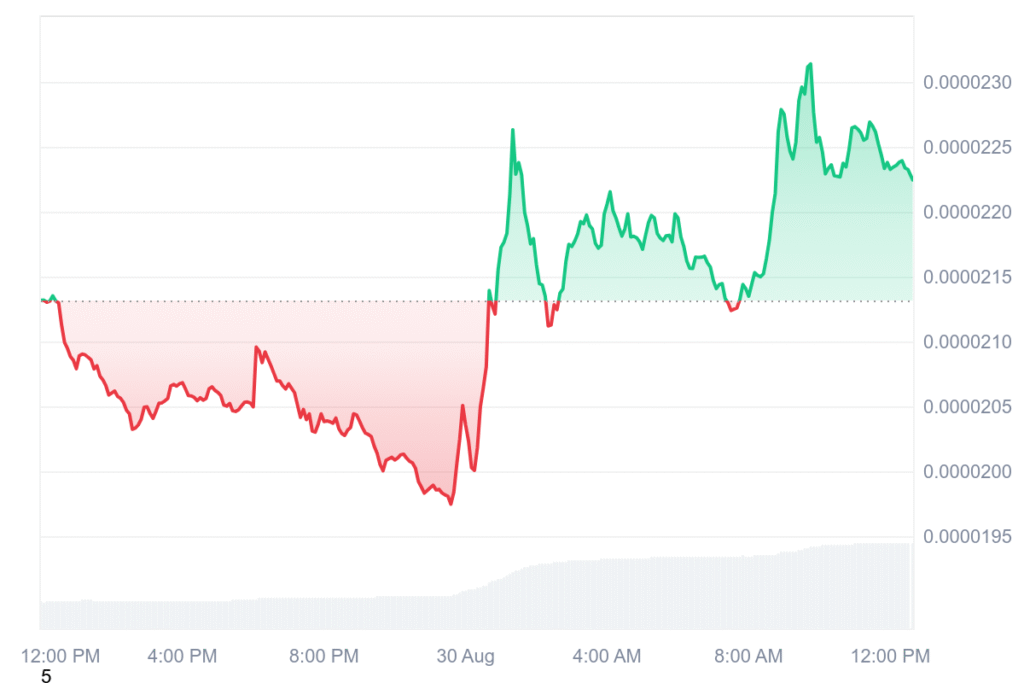

Bonk is trending today with a notable price surge. Bucking overall market rectifications, gaining continuously. There is strong investor demand expressed in a whopping more-than-210% hike in the period of the last 24 hours in the trading quantity, showing a renewed market interest.

Meme currencies that are usually termed volatile and useless in utility are making a very strong resurgence this year. Bonk is leading the trend today, rising 5% to $0.00002232 as per CoinMarketCap. The token now has a market capitalization of $1.8 billion, fueled by increased investor demand and enthusiasm amid continued market volatility in big cryptos.

Bonk’s rise is notable when the overall market is experiencing losses. Its market cap topped $632.54 million after surging by a jaw-dropping 210% in a span of 24 hours. Analysts opine that the spike is a reflection of increased investor sentiment and makes Bonk a memecoin to monitor in the year ahead.

Bonk coin is gaining momentum

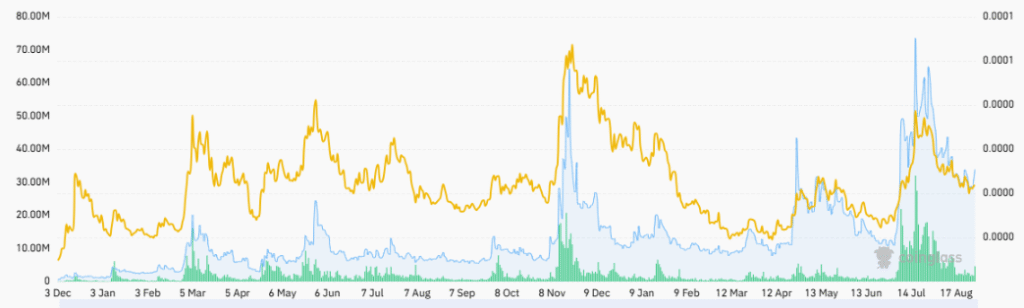

Bonk has experienced high volatility like other crypto assets, yet it maintains strong performance among meme coins. Institutional demand is supported by the price surge today, together with technical strength and increased retail adoption. Purchaser sentiment in Bonk is building up due to expectations of a shrinking circulating supply and of demand shooting up.

The Bonk development team publicly shared that they will burn 1 trillion of the tokens when the wallet threshold hits 1 million. Today’s statistics only show that 24,516 wallets will be needed in order to hit the threshold. The upcoming token burn will keep reducing supply and spark scarcity, and support the market’s bull run.

In addition, Nasdaq-listed Safely Short allocated $25 million tokens, boosting liquidity and fueling price growth. It is a bullish investment because it enhances broader adoption and the utilization of BONK among retail traders. Analysts expect the strategic investment to maintain Bonk’s momentum upwards into the coming weeks.

Bonk derivatives market update insights

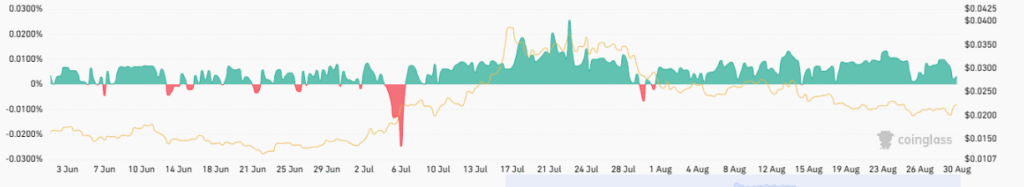

Bonk (BONK) has registered unprecedented activity in the market, with the derivatives volume surging by 216.12% to $238.71M. Such an upsurge in the volume is paired with strong rise in open interest that gained 24.55% to $35.75M. From the charts, it is clear that BONK experienced sudden spikes in market activity and price momentum in the previous months, especially in November and mid-July.

On the other hand, the Open Interest Weighted (OI Weighted) rate is at 0.0032%, showing that while the open and trade positions escalated significantly, the funding rate is actually very neutral.