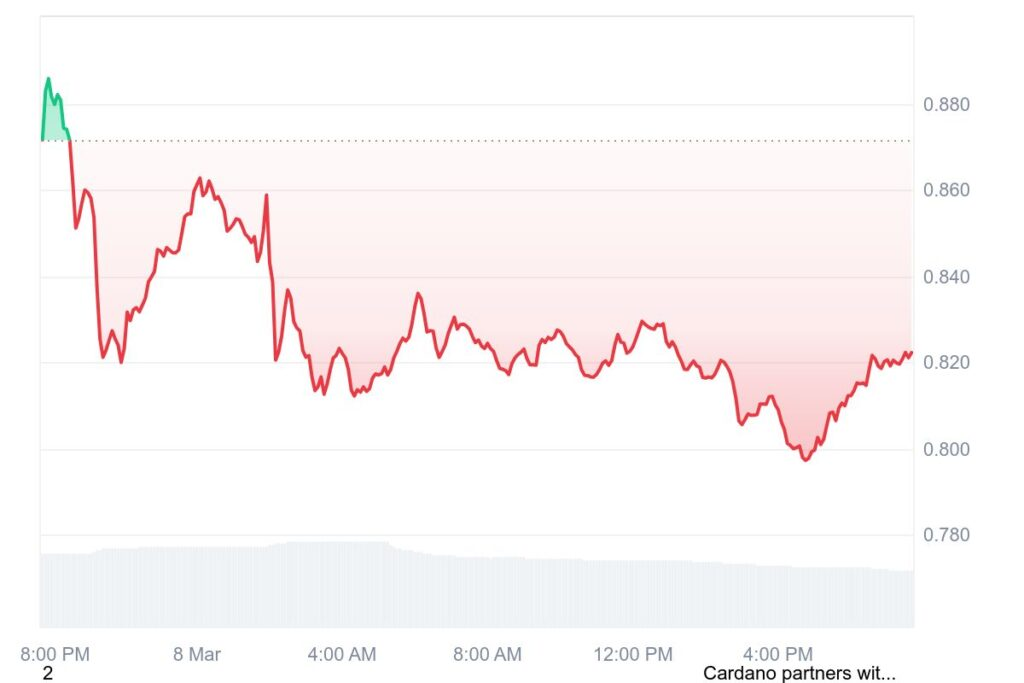

Analyst Ali recently posted on X that Cardano could surge to $10 if it stays above $0.80 and breaks $1.20. Traders closely watch these levels, looking for signs of a breakout. Cardano, struggling to hold $1, faced rejection and dropped 9% in the past 24 hours. Despite the decline, market sentiment leans bullish.

Cardano lost 16.8% in two days, struggling at the $0.99 resistance. With its price at $0.80, traders are looking at potential recovery paths. Holding above $0.77 would support a bounce. If the funding rate flips positive, ADA could reclaim $0.85 and possibly retest $0.99 and $1.00.

However, risks persist. A market downturn could push ADA below $0.77, invalidating bullish hopes and exposing it to a further fall toward $0.70. The next few trading sessions will be crucial.

Cardano shows recovery as funding rate turns positive

Cardano now trades at $0.80, showing signs of recovery. The funding rate, which has been negative for almost a week, is turning positive. This shift suggests traders are increasing long positions, reflecting renewed confidence in ADA’s upside potential.

A negative funding rate signals short sellers’ dominance and bearish sentiment. As it moves positive, buying pressure increases, potentially pushing prices higher. Many traders entered positions at lower levels, anticipating a price rebound.

Market stability vs. regulatory uncertainty

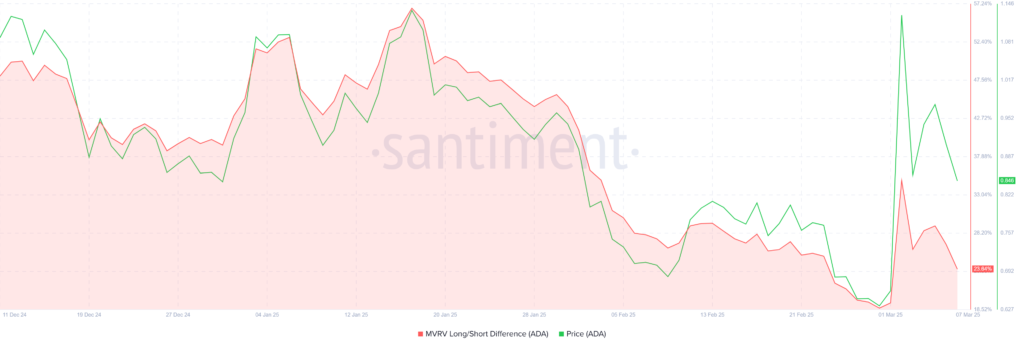

Another key metric, the Market Value to Realized Value (MVRV) Long/Short Difference, is 23%. This metric compares the profitability of long-term holders and short-term traders. A positive reading means long-term investors are in profit, reinforcing stability in the market. These investors act as strong hands, reducing the risk of panic selling.

Across the crypto market, volatility remains high. Bitcoin struggles to maintain momentum above $65,000. Ethereum faces resistance at $3,500, keeping traders cautious. Altcoins show mixed performance, with some rebounding while others extend losses.

Regulation remains a key concern. The SEC continues its crackdown on crypto firms, increasing uncertainty. Meanwhile, institutional adoption grows as companies explore blockchain integration. Countries advance their digital currency projects, moving toward central bank digital currencies (CBDCs).