Chainlink (LINK) is experiencing a notable surge in price. It has broken out of a bull flag and falling wedge pattern, signaling a potential upward movement in 2025.

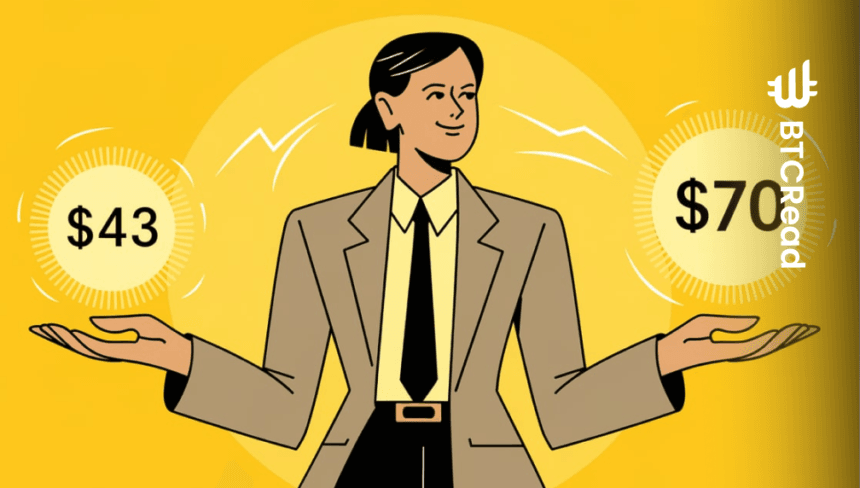

According to the latest technical analysis, with a conservative price target of $43 and an aggressive target of $70, LINK could see returns of up to 210% in the upcoming months.

The breakout, which began in late Nov. 2024, shows strong bullish signals, suggesting that LINK may continue its climb through early 2025, possibly reaching these projected levels by the end of February.

LINK’s recent price action and market overview

As of press time, Chainlink has seen positive price movement. It is currently trading at $24.29 after a 5.55% increase in the past 24 hours. The token has risen steadily throughout the day, from a low of $23.07 to its current value.

Despite the upward price, trading volume has decreased by 6.84%, totaling approximately $875.93 million for the last 24 hours. This suggests that while there is optimism in the market, investors might exercise caution before committing large amounts of capital.

Price targets and future outlook

Chainlink’s breakout from the falling wedge pattern has led to two major price targets. The conservative target (T1) of $43 represents a 95% ROI from the current price, while the more aggressive target (T2) of $70 suggests a potential 210% ROI.

The previous breakout cycle took approximately 38 days, which means that, depending on market conditions, these targets could be realized by the end of February 2025.

Given the current bullish technical indicators and strong price action, Chainlink is poised for potential growth. Investors will be watching closely as LINK continues to break key resistance levels. However, with a decrease in trading volume and rising RSI levels, it will be essential to monitor for signs of a short-term correction, particularly if volume remains low.

Key technical indicators point to bullish momentum

In the one-hour timeframe, the technical indicators for LINK suggest that the bullish trend will likely continue. The Relative Strength Index (RSI), currently at 64.72, shows that LINK is experiencing strong buying momentum but is not yet in the overbought territory (which would be above 70).

This indicates that the price could keep rising for a while before a potential correction. The RSI value of 63.90 on the moving average line further supports this, signaling sustained positive price action.

The Moving Average Convergence Divergence (MACD) indicator is also showing signs of bullish momentum. The blue MACD line, currently at 0.4645, is above the orange signal line at 0.4253, suggesting that upward pressure is still in play.

Additional support by positive bars on the MACD histogram imply that there are fresh buying signals for the LINK. However, MACD Porter at -0.0392 has a very slightly negative indication that short term momentum may dip a little but there is no sign of a reversal here.