Ethena Labs raised $10 million from ArkStream Capital, announcing new investment after its December 2024 raising of $5 million. The announcement came with a concurrent 12% value increase of ENA token, indicating rising market confidence in the DeFi protocol and its expanding ecosystem.

ArkStream cited Ethena’s rapid traction of entering capital markets and launching new products as key motivators for its investment. The corporation highlighted Ethena’s double-pronged strategy of combining equity-based capital vehicles with a crypto-native, decentralized protocol to broaden the usage of the USDe stablecoin and ENA token governance.

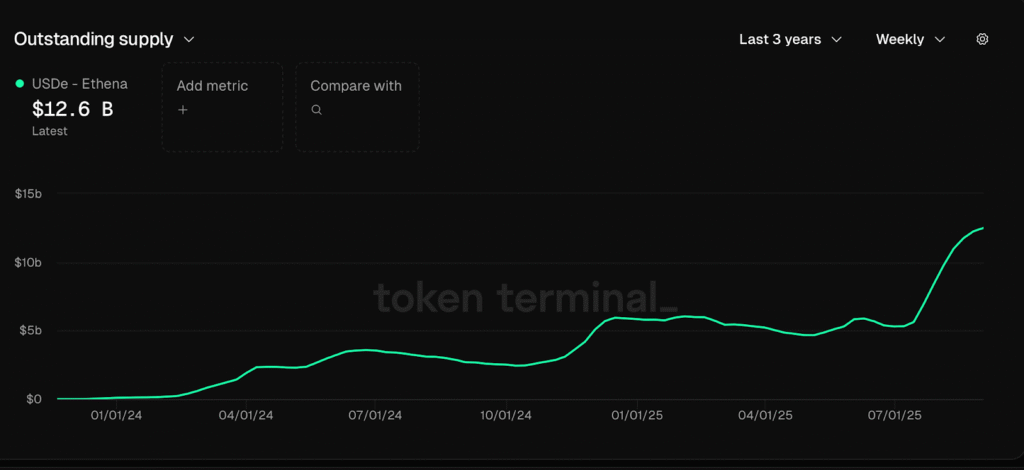

Ethena’s USDe synthetic dollar has achieved significant milestones, having gone beyond $12.5 billion supply by the end of August. USDe adoption has risen on major lending protocols, and Aave indicates $4.7 billion of Ethena-connected assets. Further, rising daily trading and revenue figures reflect its growing usage as settlement and collateral and general increased confidence in the protocol among DeFi users.

Ethena is expanding USDe availability on protocols like Telegram using the TON Blockchain. The initiative stands to provide upward of billions of worldwide users yield-generating digital dollars, mass onboarding of crypto financial products.

Ethena stablecoin hits record supply and revenue

Ethena was introduced in early 2024 and mints synthetic stablecoins like USDe and USDtb, secured by delta-neutral hedging instead of conventional reserves. The Switzerland-based Ethena Foundation oversees governance and ecosystem development, aiming to maintain the protocol’s stability while driving global adoption.

According to Binance Research, USDe became the fastest stablecoin ever to exceed $10 billion supply, reaching $12.6 billion in under ten months. The supply increased by 31% in the preceding month, according to Token Terminal. Furthermore, Ethena is currently the third-largest stablecoin issuer after Tether and Circle.

Ethena has generated over $500 million of cumulative revenue, and its weekly revenue from its protocol has exceeded $13 million. Drawing strength from increased USDe demand and returns from its hedging framework, which incorporates crypto market returns to secure its peg, has driven revenue growth and overall investor confidence.

ENA price surges amid buyback program

ENA price rose more than 12% in a single day, outperforming most cryptocurrencies. A repurchase program of $260 million, led by the Ethena Foundation, has been at the forefront. Daily purchases of $5 million steadily net tokens from supply, similar to capital return programs of traditional markets.

Major stakeholders holding 100,000 to 1 million ENA increased holdings by 12% in August. Ethena also made announcements of collaboration with Anchorage Digital to unveil GENIUS-compliant USDtb for the U.S., and Converge Chain, a USDe and USDtb-based modular blockchain utilized for gas and settlement currency, ENA staking and financial events’ growth.