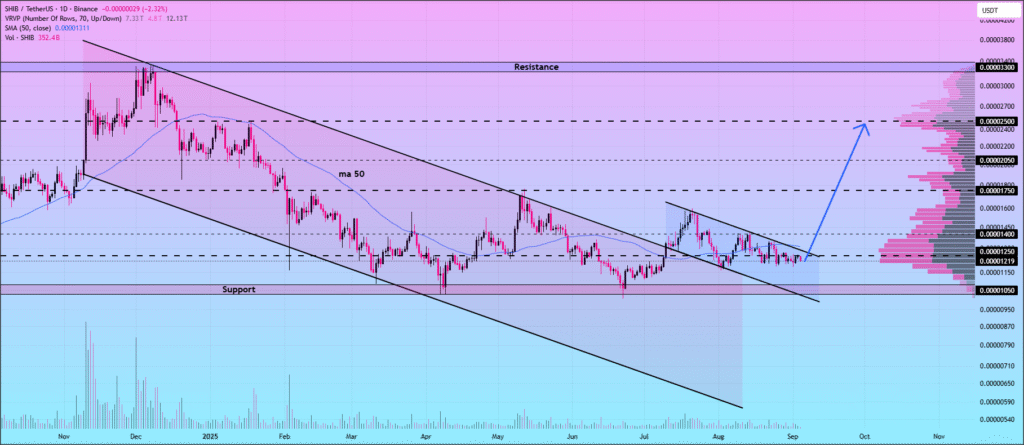

Shiba Inu (SHIB) is in focus again as crypto analyst points to a rare divergence that may trigger a significant rally. Shiba Inu has moved above the descending channel on the daily chart, and that’s a sign of a possible bullish reversal.

Prices are consolidating just below the 50-day moving average (MA 50), and momentum is building strongly. Crypto analysts believe that a surge above this MA may target $0.00001400, $0.00001750, and $0.00002500. Traders are eagerly looking for a confirmation of such an upward movement.

Technical indicators confirm such optimism. The relative strength index (RSI) signals increasing momentum, and volume trends provide hints of tranquil build-up. On historical grounds, such moves have been succeeded by quick crypto breakouts. Investors following these signals see SHIB as poised for brisk upward action in subsequent sessions.

SHIB has recently recorded an extraordinary 48,247% burn rate, contributing to scarcity. Market conditions ensure momentum throughout the entire crypto spectrum will be central to backing such high price forecasts.

Current market data shows Shiba Inu trading at $0.00001231. The 24-hour trading volume of the currency is at $198.87 million and its market capitalization at $7.26 billion with 0.19% dominance. However, SHIB price rose by 0.05% within the past 24 hours, indicating a stable performance amidst consolidation and anticipation of future breakout movements.

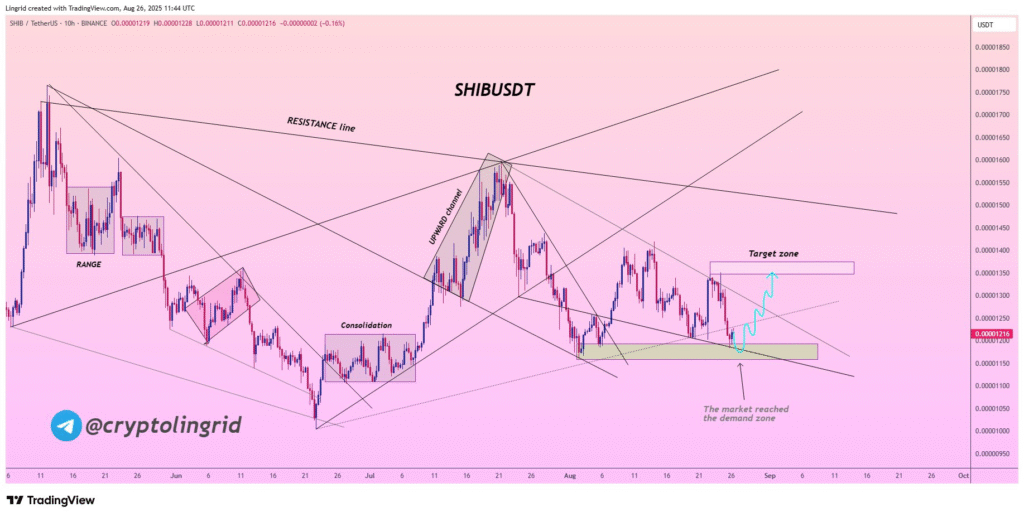

Shib bulls eye key breakout zone

Market analyst Lingrid notes SHIB is holding above key support levels, preventing deeper losses. Strong buyer support confirms a bullish tone. Lingrid continued by saying from a breakout at the level of resistance it should target $0.00001350–0.00001400, and that prevailing accumulation offers the foundation of a near-term bounce.

The analysis indicates that Shiba Inu is moving from correction to accumulation. The breakout of the downtrend channel indicates strength, and consolidation reinforces the likely upward direction. The momentum alignment will define the short-term direction of SHIB. Investors watch eagerly to discover if the positive signals create a decisive breakout.

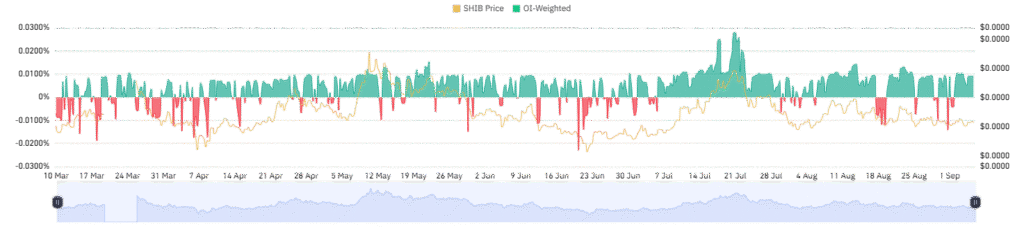

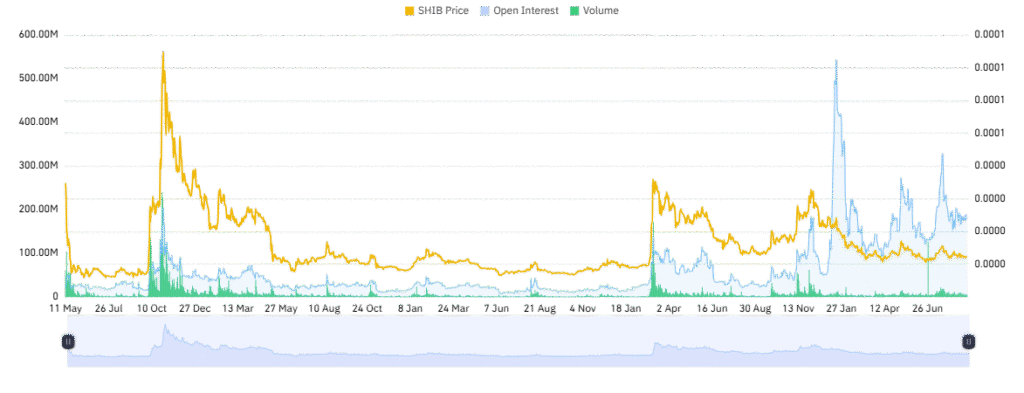

Derivative markets for Shiba Inu stay active. Trading volume for SHIB derivatives rose by 18.80% to $141.75 million, and open interest dropped negligibly by 0.54% to $178.13 million. This suggests more trading but less persistent positions, and it indicates guarded optimism among dealers with increased market participation.

The derivatives market sees a weak positive skew. The OI Weighted funding rate is 0.0092%, so the longs are paying the shorts. Although bullishly inclined in a mild sense, it doesn’t presage an overheating market. Overall, SHIB is steady and seeing constructive signs of momentum favor guarded optimism.