As Floki (FLOKI) continues to gain attention in the crypto market, its price movement remains crucial for traders and investors to monitor. Currently, Floki’s market behavior shows promise, with ongoing analysis of its macro trend and technical indicators providing valuable insights into its short-term and long-term potential.

Traders are tracking Floki’s price movement from Sept. 2023 to the present within the framework of Elliott Wave Theory. The upward movement from the bottom in Sept. 2023 likely counts as Wave 1 of the macro trend, with the wave structure becoming more complex after this initial rise.

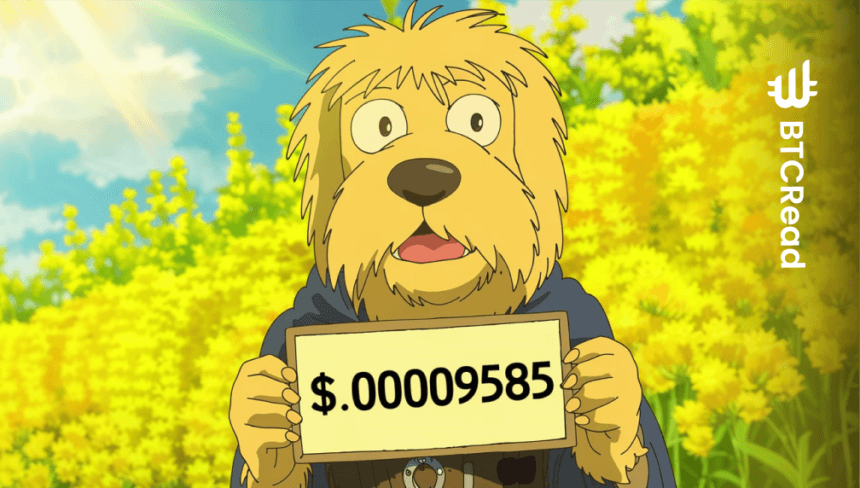

As of Jan. 2025, the market is likely in the final stages of Wave C of the corrective structure. This corrective phase could potentially lead to a higher low. Such a move would mark a significant turning point before the next bullish impulse. The critical invalidation level for this bullish structure is pegged at $0.00009585. If this price point is breached, the overall bullish outlook would be invalidated.

However, as long as the price remains above this support level, the overall structure is considered bullish. The potential for an upward swing remains strong. The most likely trade targets a price move toward the 1.618 Fibonacci extension of Wave 1. This offers a favorable risk-to-reward scenario of around 1 to 10.

Floki’s market data: A snapshot of current performance

During the time of writing, Floki was trading at $0.0001449, marking an increase of 2.26% over the past 24 hours. With a market capitalization of $1.39 billion and a 24-hour trading volume of $228.74 million, Floki remains actively traded in the market. However, the decrease in trading volume by 45.07% points to a potential slowdown in market interest.

Floki’s circulating supply is 9.67 trillion, with all tokens currently circulating. This full supply indicates that no further tokens are expected to be released, which may influence long-term scarcity and price action.

RSI and MACD indicators: Mixed signals for future price action

Floki’s technical analysis also includes two key indicators: the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicators. The market sits near neutral, as confirmed by its RSI reading of 48.82. It shows no clear signs of being excessively bought or excessively sold. The price movement would shift when the indicator breaks through its 40 or 51.64 unique resistance points.

The MACD technical indicator points up since the MACD line runs above its signal line. As the histogram bars become smaller, the bullish momentum disappears. When the MACD keeps going higher than the signal line, it shows more price increases ahead, but a cross with the line shows the price turning down.