U.S. President Donald Trump has imposed tariffs on major trading partners like Canada, Mexico, and China, which has caused the stock and cryptocurrency markets to drop significantly.

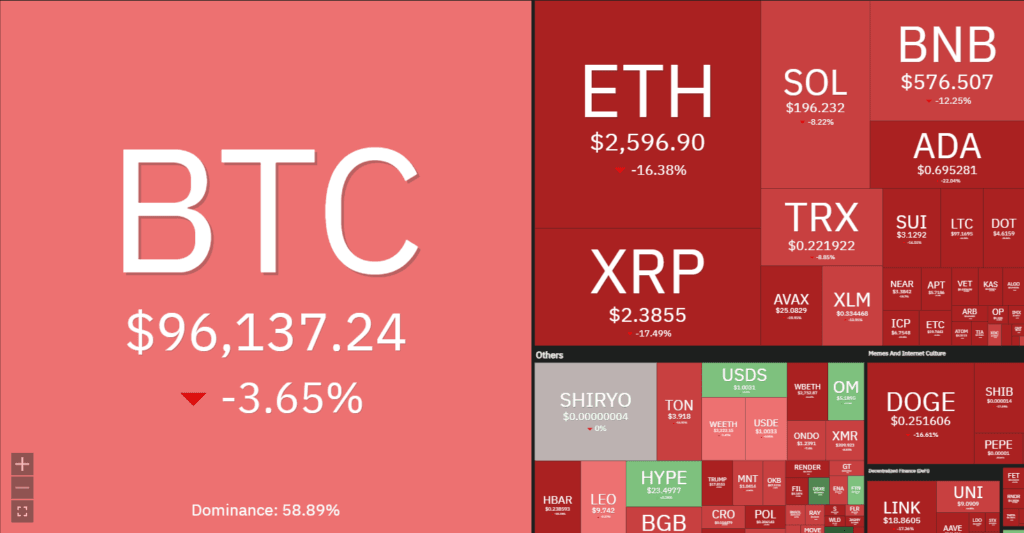

Bitcoin (BTC) fell below $100,000 on Feb. 3, and altcoins such as XRP and Cardano saw decreases of over 17% and 22%, respectively. Trump’s World Liberty Financial portfolio also lost more than 20% of its value.

The total amount lost in the market is estimated to be between $8 billion and $10 billion. The CEO of the cryptocurrency exchange Bybit, Ben Zhou, reported that Bybit alone had $2.1 billion in liquidations in 24 hours.

More tariffs are on the horizon starting Feb. 18

Starting Feb. 18, Trump plans to introduce more tariffs on the European Union and other commodities, such as superconductors, oil, gas, steel, and copper.

While some investors think now is a good time to buy Bitcoin, many analysts warn that these tariffs could lead to further price drops and increase uncertainty in the market.

More people are adopting Bitcoin, and its role is changing. People are debating whether Bitcoin is a risk-on asset, influenced by market factors and investors’ confidence, or a risk-off asset, which serves as a safe investment during uncertain times.

Many analysts perceive Bitcoin as a risk-on asset. As per the statement by Analyst Amit Kukreja, crypto is not a safe haven. Bitcoin is liquidity-dependent, and liquidity drops with tariffs. Economist Alex Krüger stated that such tariffs are not a positive sign for risky assets like Bitcoin and that the economy will suffer.

Previous cycle patterns raise concerns for Bitcoin

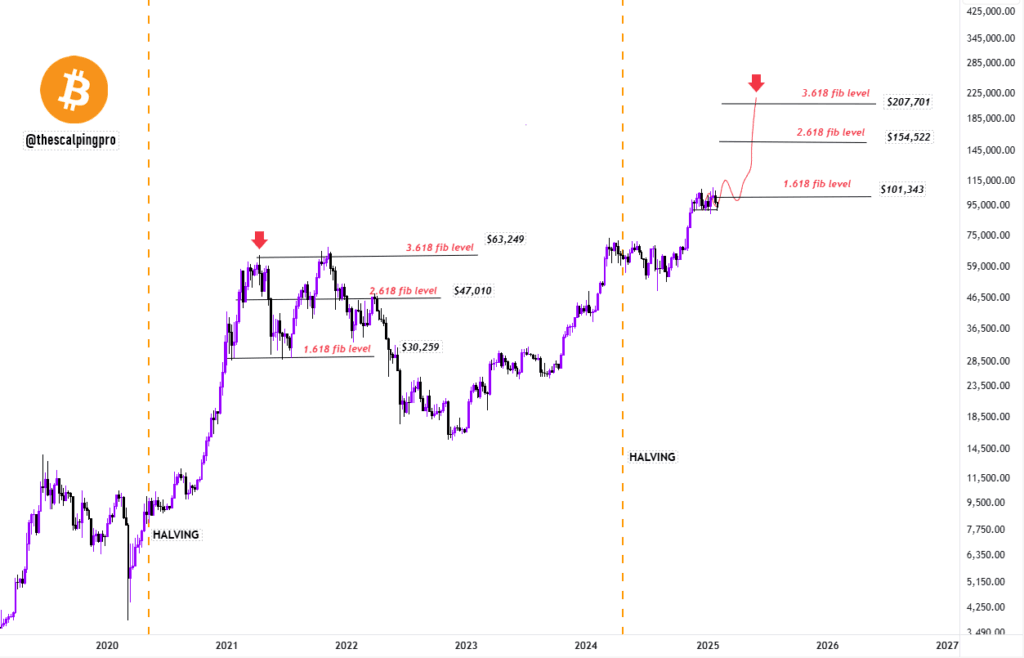

Nevertheless, Bitcoin’s current price action has been contentious, with observer Mags inquiring whether “it’s over” in a rejection at a key Fibonacci extension level. Bitcoin price discovery is consistently drawn in price resistances, with 1.618, 2.618, and 3.618 being key markers.

In the previous cycle, Bitcoin reached its peak at 3.618 and then plunged into a long-term downtrend. Bitcoin is struggling to break through 1.618 at current times, which reflects a near-term hurdle.

If BTC can break through and establish a base at this level of resistance, its target will be 2.618 at $154,522 and 3.618 at $207,701. All eyes will then be on these price values, with Bitcoin’s direction not yet determined.