Bitcoin has seen a surge in activity in the U.S. since the launch of spot BTC ETFs. In contrast, stablecoin adoption in the U.S. has slowed in 2024, especially compared to other global markets.

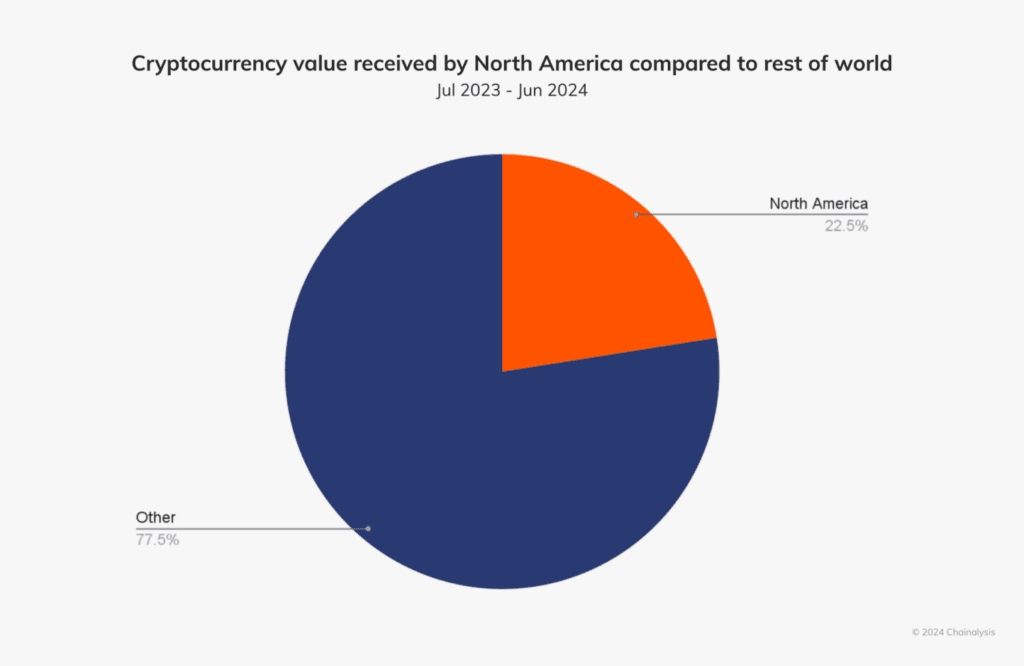

As per Chainalysis, North America is still the largest cryptocurrency market, receiving $1.3 trillion on-chain in value from July 2023 to June 2024. This accounts for 22.5% of the global market activity.

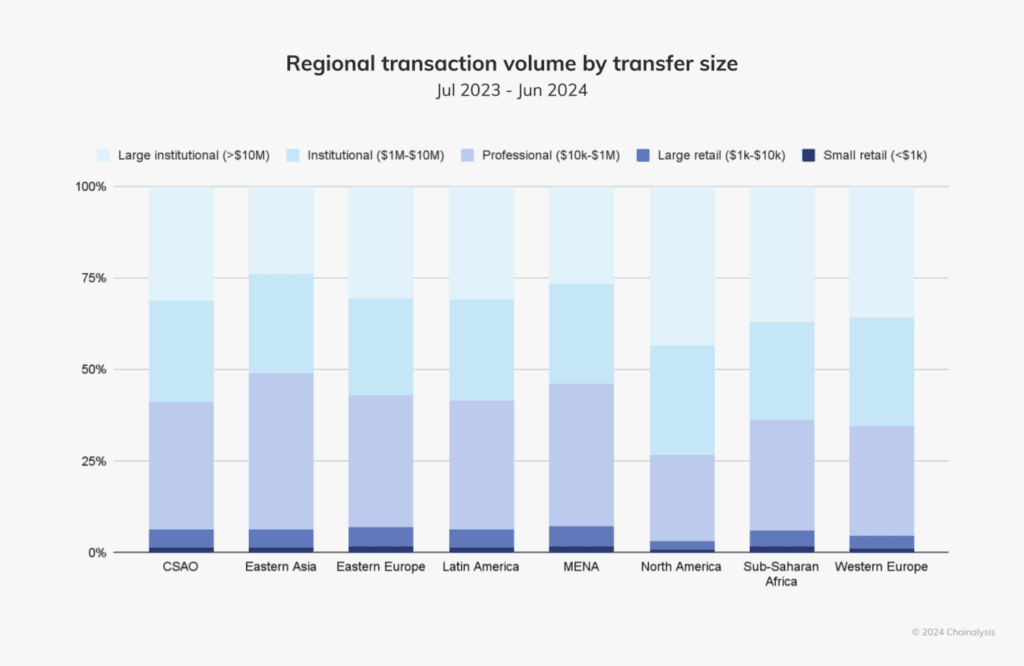

It is the institutional activity that is pushing the region forward to its dominance. Transfers over $1 million account for approximately 70% of the crypto transactions in North America. This illustrates that the U.S. market faces great influence from the major financial players.

Bitcoin bounces back in 2024 after challenging 2023

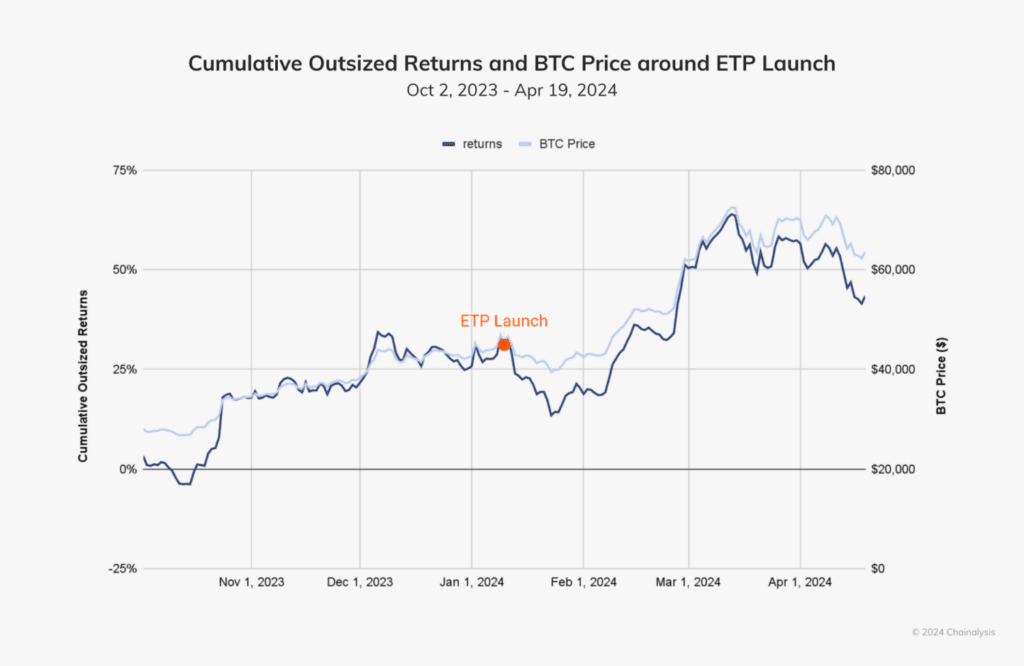

The U.S. has had a significant year in crypto adoption. After a tough 2023, marked by FTX’s collapse and Silicon Valley Bank’s failure, the North American crypto scene bounced back. By March 2024, Bitcoin reached an all-time high of $73,000, signaling recovery and growth.

Institutional interest in crypto has grown with the launch of spot BTC ETFs in the U.S. Retail and institutional investors are drawn to these funds as they offer an easier way to access Bitcoin.

Big names like Goldman Sachs, Fidelity, and BlackRock have taken firm positions in the crypto space. This marks a shift, pushing cryptocurrency into the mainstream.

Stablecoin usage declines in the U.S

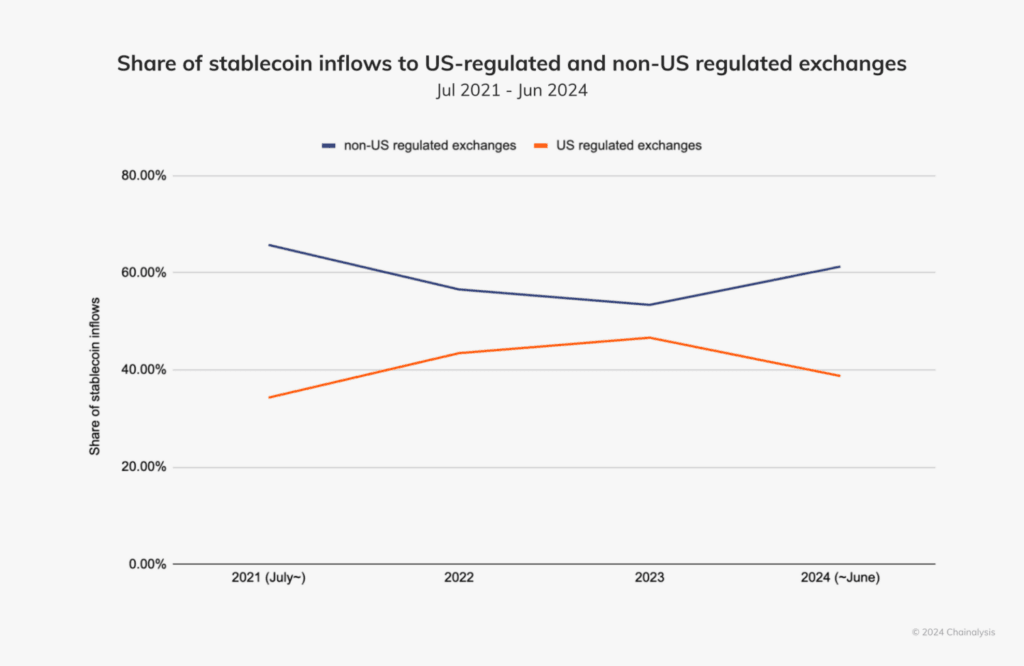

However, stablecoin usage in the U.S. has declined. Emerging markets have increased their adoption, leaving the U.S. lagging behind. The lack of regulatory clarity in the U.S. is partly responsible for this trend.

Globally, stablecoin transactions are increasing faster in platforms that are not regulated by the U.S. Whereas the U.S. also remains a major player in the markets, the speed with which the technology has been embraced in other areas could challenge its position.

Nevertheless, ETFs are now becoming popular, and stablecoins are growing in other parts of the world. The U.S. cryptoscape is the most dynamic sector.

While institutional interest is still rising, stablecoin growth in this country has slowed down. The balance between regulation and innovation will decide the role of the U.S. in the global cryptocurrency market.

Related | Grayscale adds 35 altcoins, including Dogecoin and Worldcoin