Sui validators approved a proposal to return $162 million in frozen funds linked to a recent hack of the decentralized exchange Cetus. This marked an important step toward fully reimbursing users.

On May. 22, Cetus lost over $220 million in digital assets to an exploit. However, validators quickly froze about $162 million of the stolen funds.

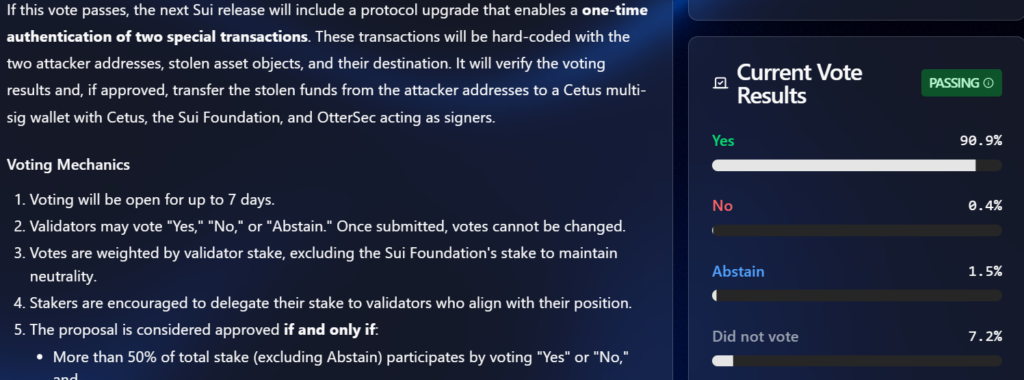

Sui validators voted on the recovery proposal on May. 29, with 90.9% in favor, 1.5% abstaining, and 7.2% not participating, according to the network’s official governance page. Sui said in an X post:

With this result, the impacted funds will be moved to a multisig wallet and held in trust until they can be returned to users according to the plan led by Cetus.

Sui fund freeze sparks debate

The decision comes after a debate within the crypto community about whether validators should have the power to freeze funds on the blockchain.

While some decentralization supporters criticized validators for having the power to freeze funds, others in the industry praised the swift action as a positive step in combating the rise of crypto-related exploits.

The community vote is part of a larger recovery effort. It includes using funds from Cetus’s treasury and securing an emergency loan from the Sui Foundation. Cetus thanked the community for the rapid support and shared its recovery plan following the conclusion of the vote.

Cetus targets full restart and fund recovery

First, Sui validators will implement the upgrade to transfer the frozen funds into the Cetus multisignature wallet. After that, Cetus can begin the upgrade for its emergency recovery pool and complete data restoration.

The protocol said in a May. 29 post on X that Cetus plans to fully recover and restart in about a week. A dedicated compensation contract is under development and will undergo auditor review before deployment.

After the full protocol restart, all liquidity providers in the affected pools will get back their recovered funds and any leftover losses can be claimed through the compensation contract.