A new proposal has been submitted for Aave that suggests hardcoding the price of Ethena’s USDe to align with Tether’s USDT in Aave’s pricing feeds.

The current proposal, jointly by Chaos Labs and LlamaRisk, came into view on Jan. 3. Thus, the mission would shield Aave users from further risks linked with unstable secondary market prices of USDe.

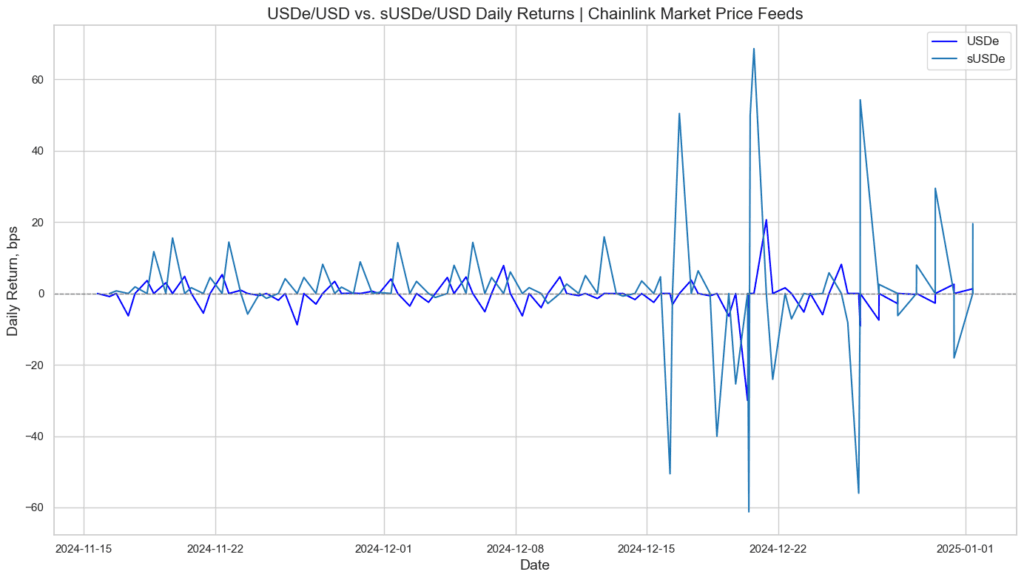

This solution for a better approach has its complete backing with LlamaRisk as the company belongs to the risk committee. Currently, AAVE’s price oracle method for sUSDe includes an exchange rate between sUSDe/USDe, a CAPO adapter, and Chainlink’s secondary market price feed for USDe/USD.

However, recent observations have shown that a 2.5% deviation by USDe could see a quarter of the sUSDe-backed positions liquidated. The recent deviation has, therefore, created significant risks, which are now heightened since USDe has started trading slightly below its peg.

The proposed fix replaces the USDe/USD price feed with a 1:1 USDe/USDT rate. It would remove any dependency on the volatile market price of USDe. It drives most of the liquidation risk in the current system. According to this proposal, the change will be advantageous to Aave users by giving stability to loan-to-value ratios.

Aave addresses collateralization and bad debt concerns

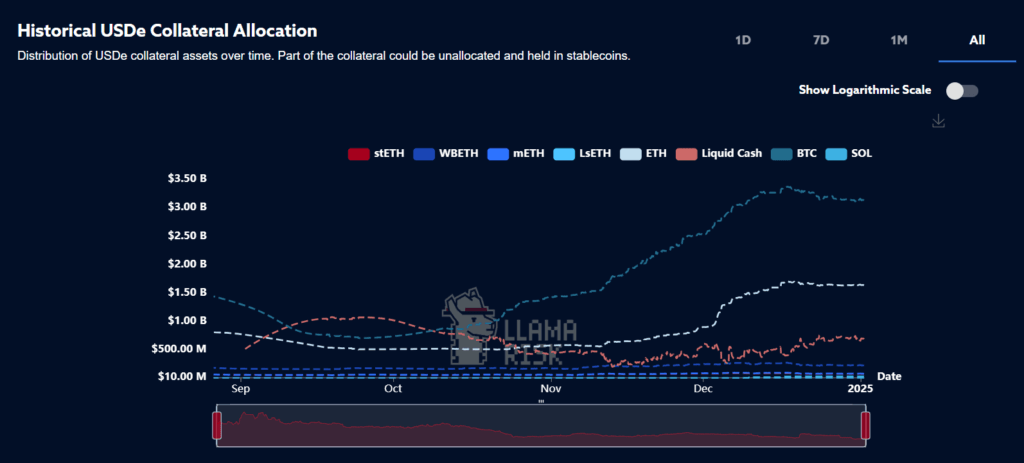

Aave’s proposal also considers the collateralization of USDe and its pegging relationship with USDT. In such a scenario of high redemption, depegging USDe might lead to longer depegging for sUSDe. It would increase the possibility of bad debt. The new pricing mechanism can manage this and reduce volatility linked to USDe.

The proposal outlines some security features in the operation of Ethena that stabilize USDe against collateral and buffer risks through the on-chain stablecoin buffer mechanism to protect against unexpected or instant losses. A stable market during market turmoil with no generation of bad debt or losses arising could be very impressive.

In general, the proposed changes seek to enhance the stability of loans backed by sUSDe, protect borrowers from sudden liquidations, and shift the solvency risk onto Aave’s protocol to better protect its users.