81.05% of Dogecoin ($DOGE) traders on Binance expect the price to rise. This indicates a very high concentration of long positions, which shows an increasing perception of the meme coin’s potential. Analyst Ali notes that the long-to-short ratio currently stands at 4.28, showing that there are more traders who believe that the price will rise than those who believe that it will fall.

Market trends drive optimism for Dogecoin’s growth

From the attached long/short ratio chart, green bars are used to represent the long positions, and they dominate the chart. In the context of the market, 18.95% of traders are holding short positions, which strictly supports the upcoming growth of DOGE. Also, the funding rate on CoinGlass is positive, meaning that shorters are willing to pay for the chance to keep their longs open, which means that they expect the prices to grow.

Renewed interest in meme coins and the optimistic cryptocurrency market drive Dogecoin’s continued bullishness. Certain details concerning DOGE may also affect this growth. However, the experts argue that a high long/short ratio indicates that the market is enthusiastic, although it could lead to instability in case of a change of sentiment.

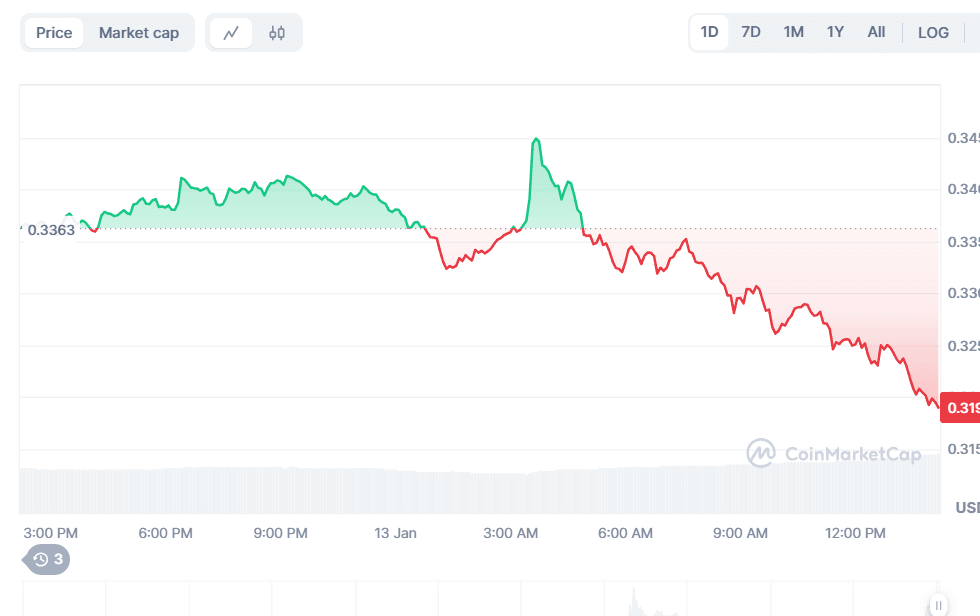

Dogecoin shows moderate volatility with peaks near $0.3450

Traders should be careful since markets are volatile, and large positions may be liquidated if the price moves in the opposite direction of expectations. However, the present market data reflects the enthusiasm that is a driving force behind Dogecoin’s growth. Binance trading activity provides the community’s sentiment, focusing on key aspects that make trading in crypto exciting and challenging.

Over the last day, the price of DOGE has fluctuated between $0.3215 and $0.3450, indicating mild volatility. It rose to a high of nearly $0.3450 before falling back to almost $0.320 at the close. Average trading activity patterns consistently align with market sentiment, reflecting this type of movement.