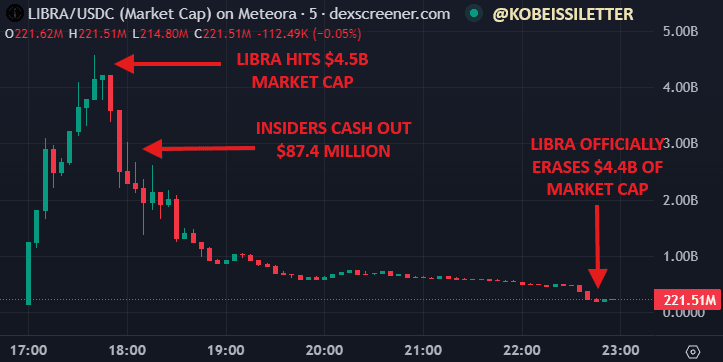

The launch of the Libra token sent shockwaves through the crypto world. Investors jumped in, hoping for massive gains. Instead, they watched their holdings vanish. A sudden crash wiped out $4 billion in market value within hours.

Memecoin insiders had known about the launch weeks before it went public. Information spread in private circles. Those in the know had time to act before the wider market got a chance. The collapse that followed shattered trust once again.

Reports from Jupiter Exchange pointed to eight insider wallets. These wallets dumped $107 million worth of liquidity before the crash. The fallout left traders scrambling for answers. Panic gripped the market. Prices plummeted as investors rushed to exit.

The controversy grew when details emerged about advanced knowledge within Jupiter Exchange. Some members knew about the token’s launch two weeks prior. Their silence fueled suspicion. The exchange denied wrongdoing but admitted that a few individuals were aware.

Market manipulation allegations spread quickly. Traders accused insiders of playing a dirty game. The memecoin market, already volatile, became a battlefield. Fear and uncertainty replaced the initial hype.

Argentine President Javier Milei’s endorsement added another layer of intrigue. His support gave credibility to the token. Many believed this was a government-backed project. That belief proved costly. The rapid price crash left thousands with heavy losses.

Jupiter exchange and the Libra controversy

Jupiter Exchange attempted damage control. They insisted that no team members received LIBRA tokens. They also claimed no one on their team traded on insider information. But skepticism remained. The memecoin space had seen too many pump-and-dump schemes before.

The timing of the verification process also raised eyebrows. LIBRA received a verified status only after hitting a $1.5 billion market cap. Critics argued this gave the illusion of legitimacy. Traders who bought in at that point were left holding worthless tokens just hours later.

The debacle left lasting scars. Confidence in memecoins took another hit. Investors demanded better safeguards. Calls for stricter regulations grew louder.